- If you receive an email from anytime-banque or @anytime-placements, do not reply or send any documents. Contact Anytime Customer Service!

- These bogus advisors sell credit or make you believe they'll provide you with financial assistance.

- These bogus advisors sell bogus investment products such as a bogus savings account.

We will never offer you investment or speculative transactions.

Neobanks likeAnytime offer banking services, they are payment institutions. We provide payment services to individuals and companies. No Anytime advisor will be able to offer you overdraft, credit or investment products.

If you receive such proposals, please do not hesitate to send them to us via our dedicated contact form.

Anytime strengthens its video account opening procedures

For the security of our customers, we have decided to reinforce the opening of your Anytime account. When you apply to open an account on https://secure.anyti.me/, to combat identity theft, we replace the traditional selfie with a video interaction that verifies the identity document and the account holder. If fraudsters have stolen your identity documents, they will be unusable to open an account with Anytime. Discover our new security features

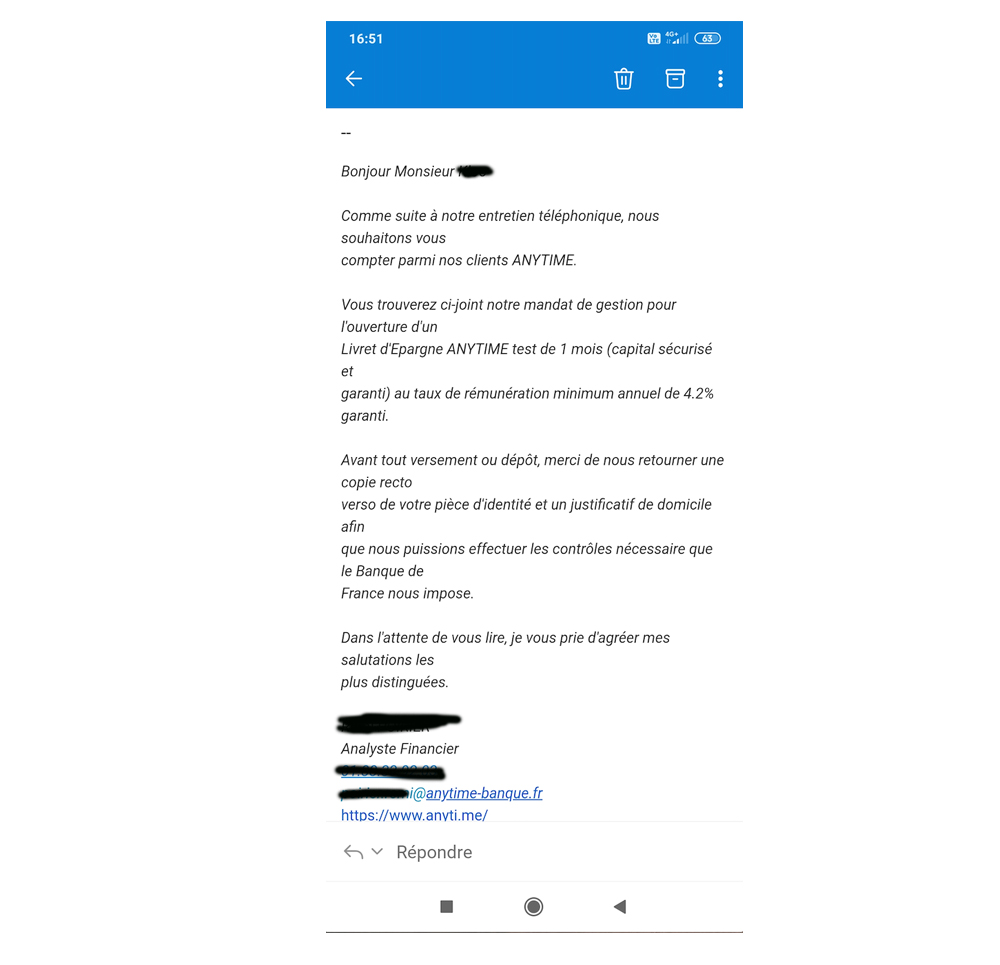

Here is an example of messages you may have received from fraudsters

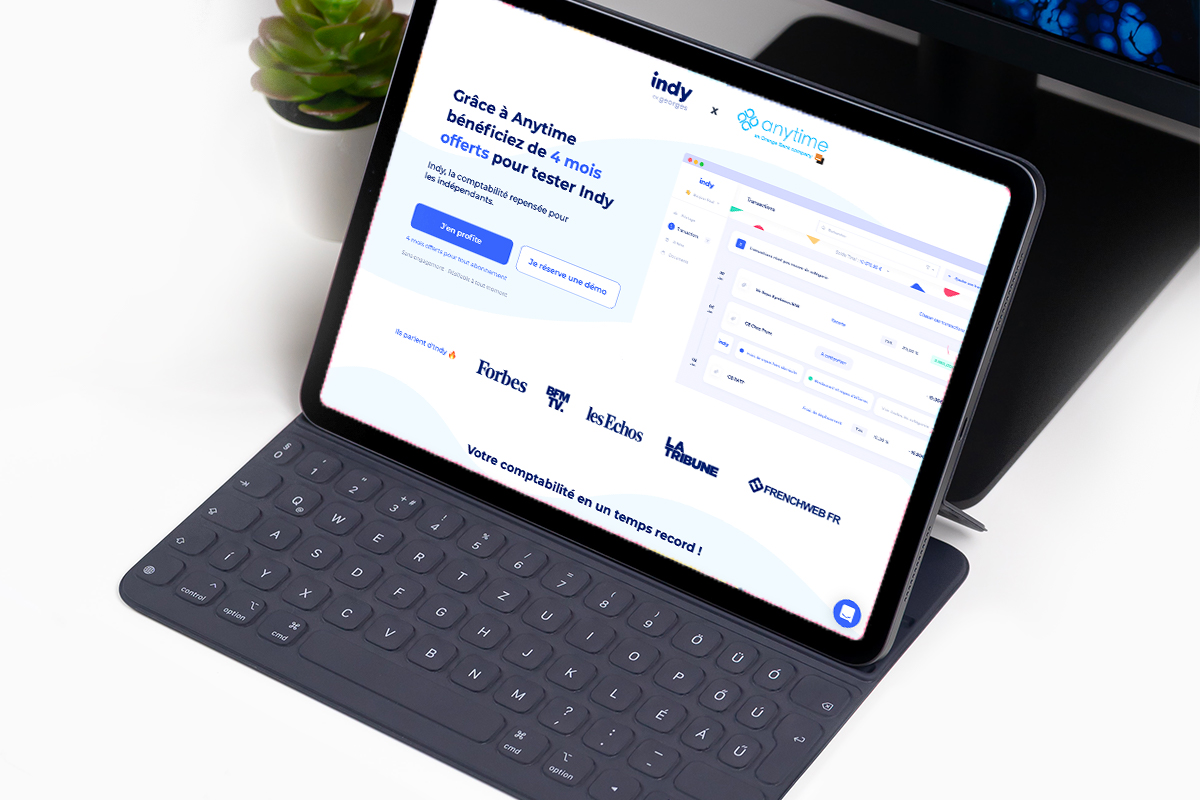

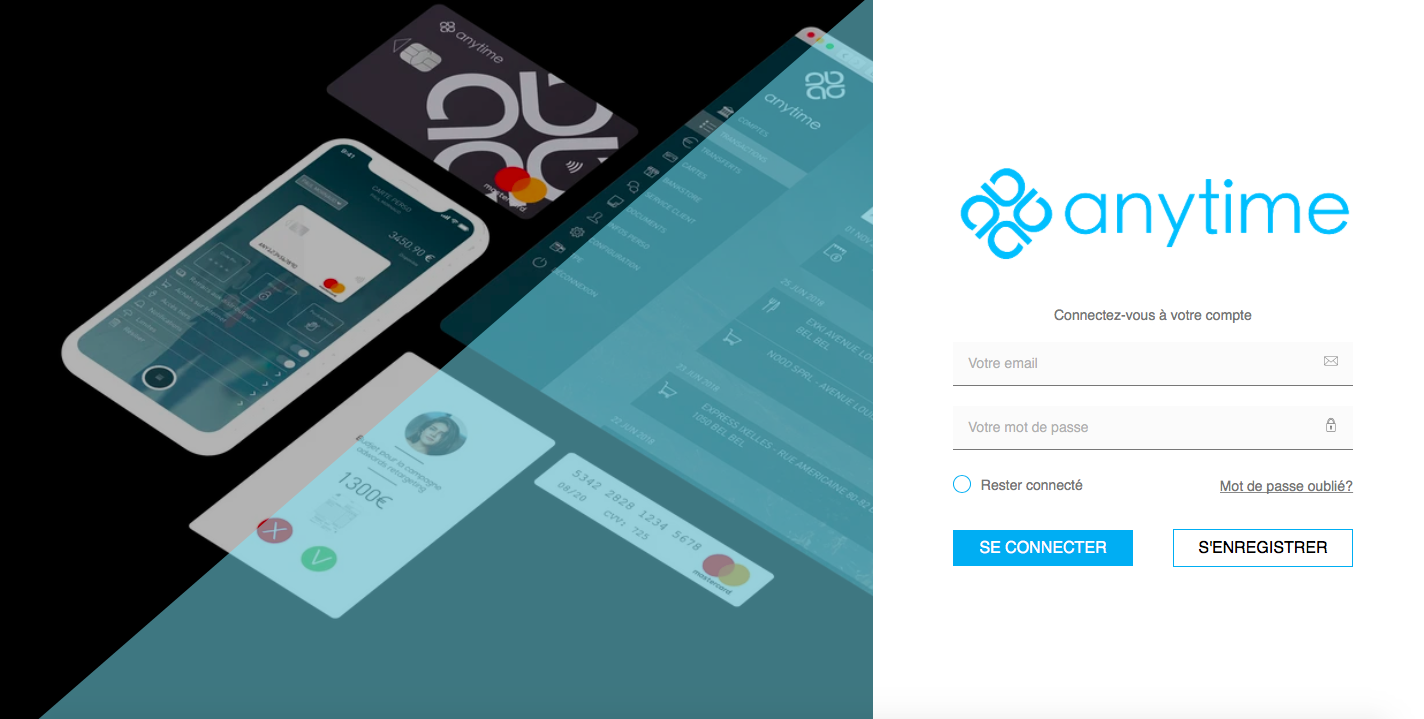

Example of a fake Anytime site (called a mirror site)

Example of an email sent by fraudsters

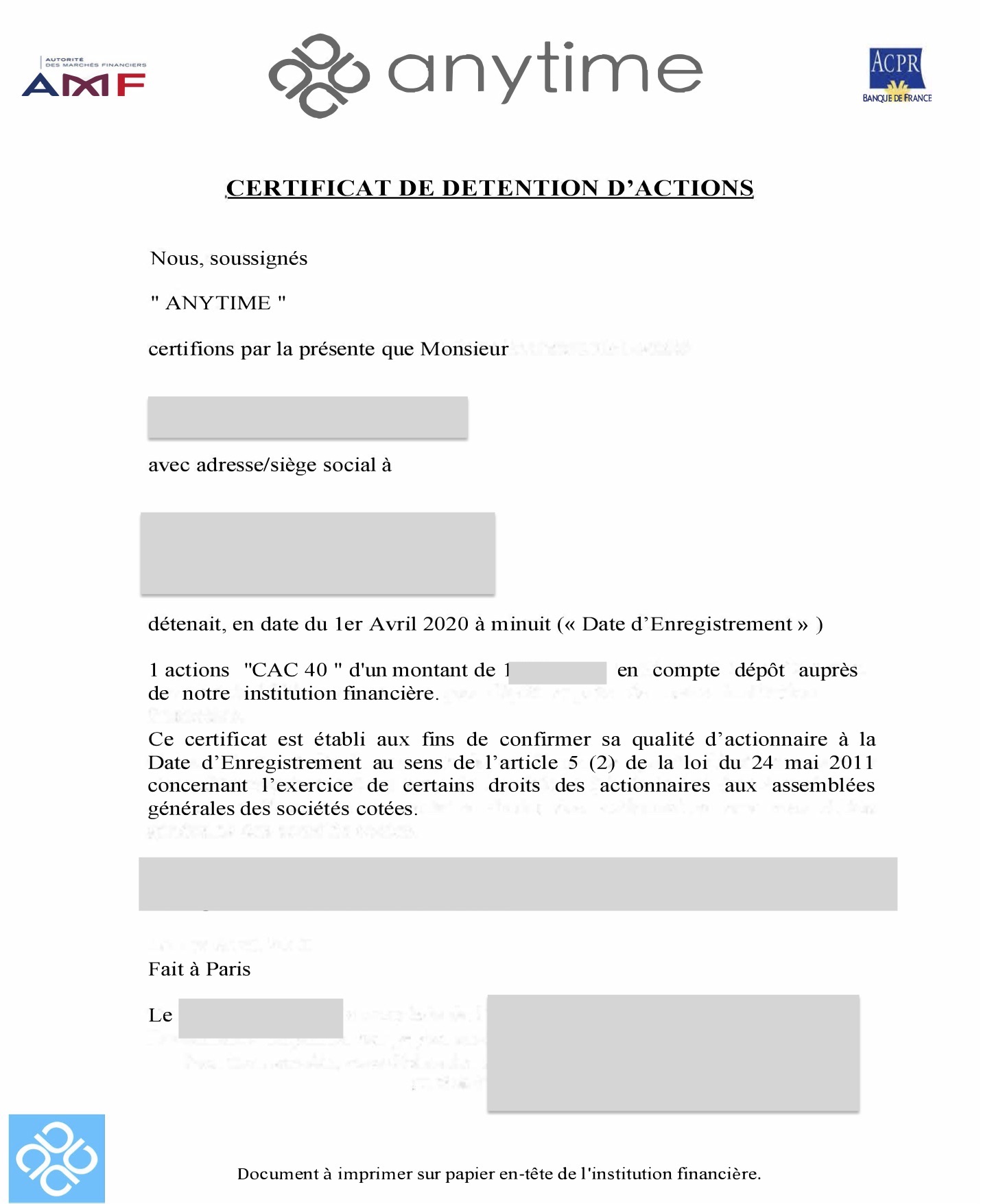

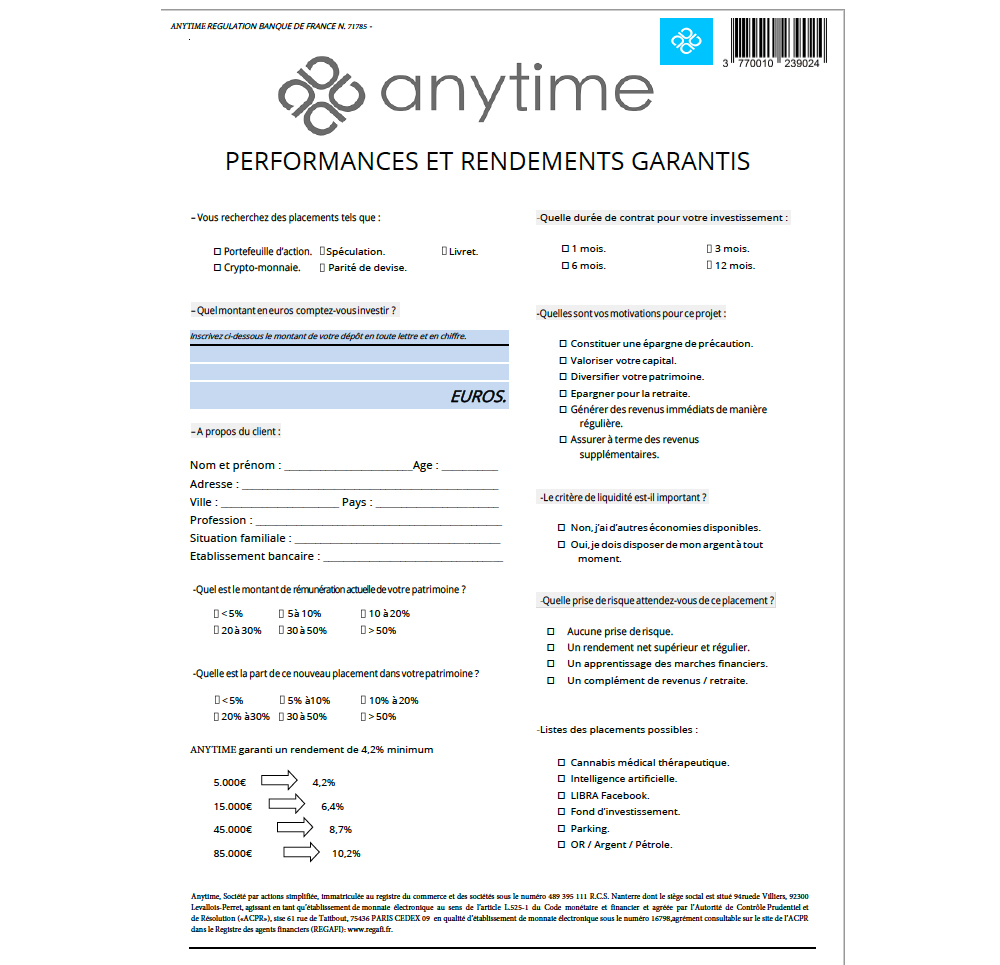

Example of a fake PDF document

What should you do if you have been in contact with a fraudster or sent documents?

We have set up a dedicated form so that you can alert us as quickly as possible if you think you've been a victim of fraud.

How do fraudsters attack you?

Don't fall into the trap. With the Coronavirus crisis, the risks are increasing.

Pirates and fraudsters are ready to exploit any dramatic event (tsunami, terrorist attack, pandemic, financial problems...) to trap you.

We all receive malicious e-mails (phishing) that appeal to our emotions, our sense of civic responsibility or simply our curiosity. These emails invite us to perform a specific action with the aim of :

- steal personal information

- open or execute a corrupted file or infected attachment

- send identity documents

- to log in urgently with login and password on a fake site reminiscent of Anytime.

What subjects are hackers exploiting?

- Granting credit,

- Reimbursement of VAT, taxes, URSSAF, RSI, ASSEDIC, Social Security...

- Fake computer procedure to connect remotely to your computer (teleworking),

- Call for donations,

- Health and medical advice, sale of medical equipment such as masks, hydroalcoholic gel, gloves and essential products

- Government orders,

- Fake news, fake sites (maps, statistics...,

- False promotions (free VOD, premium subscription...),

- Humorous content

These attacks can also be distributed via SMS (SMSishing) or mobile applications.

Best practices

- Don't click on dubious links. Type the address of the legitimate site directly into your web browser.

- Beware of emails from unknown senders. Be sure to check the full e-mail address. Beware of aliases.

- Do not share any personal information (login, password, credit card, etc.) by e-mail or on a site that has been sent to you by e-mail or SMS.

- Do not download applications (including mobile ones) related to Covid-19

Please note that the Anytime team will NEVER ask you for your password, card number or PIN by e-mail.

If you have the slightest suspicion that you are being defrauded, please contact our Customer Service immediately.

To find out more

Focus on phishing threats

Hackers systematically use tragic news events to try and trick their victims. Malicious e-mails are on the increase. The coronavirus epidemic is no exception. Whether in your professional or personal life, you can be the target of numerous scams: fake remote connection procedures, calls for donations, enticing proposals for loans of all kinds... How can you avoid the pitfalls of phishing?

What is phishing?

Phishing is a technique used to obtain personal information from you. The criminal poses as a trusted third party to try to obtain information from you, such as photocopies of your identity documents, proof of address, passwords and credit card numbers.

How does it work?

Hackers have well-thought-out scenarios for achieving their goals. They will appeal to our emotions, our sense of civic responsibility or simply our curiosity. You receive an e-mail inviting you to perform a very specific action with the aim of stealing your personal information: open or execute a corrupted file or infected attachment, send documents relating to your identity, connect urgently with your login and password on a site...

Let's imagine a simple example. You receive an e-mail from Anytime with a proposal for an exceptional loan in response to the difficulties encountered by entrepreneurs as a result of the Coronavirus. For this, you are asked to provide your personal documents (ID, proof of address, KBis extract, etc.) and to pay a deposit on a RIB. In fact, this is a fraudster who, in addition to recovering your money, can use your documents to open bank accounts in your name.

You may also be asked to pay an overdue bill quickly, and the e-mail will send you to a "mirror site", i.e. a website designed to make you think you're logging on to the official website. You enter your login and password on the fake site: the criminal can then connect to the official site with your credentials to commit his misdeeds without any problems.

What measures does Anytime take?

Your security is our top priority. We are always looking for additional measures to protect you against scam attempts.

- To combat identity theft, we're replacing the traditional selfie with a video call to an agent who will check the ID and the holder.

- Strong DSP2 authentication to connect to your Anytime customer area (fingerprint identification, SMS token...)

- Change your mobile number. An Anytime agent calls you back to verify your identity

- Single-use virtual cards. A card dedicated to a single purchase, reducing the risk of credit card fraud.

- You can block the functions of your bank card at any time

Every day, the Anytime teams optimize the security of your bank account. But you also need to be vigilant and cautious. Follow the advice given on this page and you should stay safe from scams.