As a self-employed person or company director, protecting yourself in the event of health problems is essential. That's why Anytime has decided to give you a helping hand by teaming up with Stello.

Anytime 's ambition has always been to simplify the life of the entrepreneur, to take him away from day-to-day paperwork and focus on what's essential: his core business!

Benefits 💯

- Our offers are tailored to your profile. 🧵

- The same guarantees are available for your spouse and children. 👨👩👧👦

- The application and customer area is accessible 24 hours a day 📱

- Coverage is immediate, you get your certificate instantly. 🚀

-

If you're already insured, we'll take care of cancelling your old mutual. ✋

➡️ Discover the offer

Offers 🎁

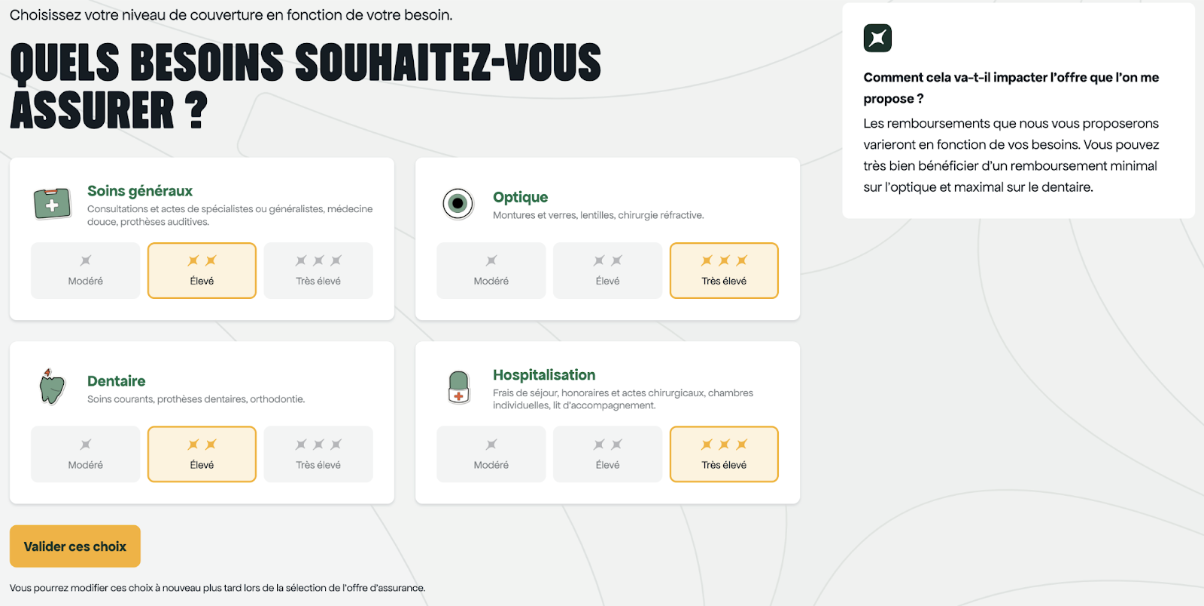

As soon as you register, you can modulate the amounts covered by each service, so you know exactly what is included in your price - no nasty surprises!

General care 👨⚕️

Because every self-employed person has different needs, mutuelle pro covers medical consultations according to your actual requirements. These may include your general practitioner, but also specialists such as: your cardiologist, your psychiatrist, your gynecologist, your ophthalmologist, your dermatologist, your cardiologist, etc.

As your family can also subscribe to this mutual, you can be covered for pediatric consultations 👶

Alternative medicine 🧘♂️

And that's not all: the mutual insurance company adapts to your preferences and also covers osteopathy, sophrology, acupuncture, chiropractic, homeopathy, phytotherapy and mesotherapy up to €180 per year.

Optics 👀

With mutual insurance, you can be reimbursed up to €350 for glasses (lenses only) and €200 for contact lenses, depending on your coverage.

Dental 🦷

Dental treatments such as scaling, crowns and implants are covered, and you also benefit from 100% healthcare with quality care and no out-of-pocket expenses.

For each year of coverage, this means €580 for children's orthodontics and up to €1,500 for adults.

How do I subscribe?

-

Go to your Customer Area 👤 , in the Insurance section ☂️

-

Select the Mutuelle dirigeants & indépendants insurance 🙋♂️

-

You will then be directed to the website of our partner Stello

-

Click on "Modify my offer

-

Fill in your information and choose your health needs 💡

-

Sign your contracts online 🖊 Pay by direct debit(you can choose between annual or monthly payments) 📆

-

After payment, you'll receive your insurance certificate 📄 so you're immediately covered in the event of damage!

-

You manage your mutual online and can modify your needs from your secure space. 📱

Questions you may have

I'm already insured. What happens?

Changing insurer has never been so quick and easy! Stello takes care of all the formalities involved in cancelling your mutual insurance policy, free of charge!

➡️ Get my quote

How long is my commitment?

The minimum duration of a mutual insurance contract is 1 year. After that, you can cancel whenever you like, subject to 1 month's notice. This flexibility is possible thanks to the PACTE Law, which allows you to play the competition and change more easily.

Can I deduct my health insurance from my taxable income?

Yes, if, as a self-employed worker, you declare your income on an actual basis (and not on a flat-rate basis, as is the case for micro-enterprises, for example) and you have a"Madelin" mutual insurance plan. To qualify for this label, the mutual must meet a number of criteria in terms of reimbursement thresholds and ceilings, and provide you with a"Madelin attestation".

At Stello you'll find your certificate in your customer area at the end of the year, so you can file your tax return.