Over the past few years, the independent courier business has been booming, particularly in France's major cities. The reason for this success? The emergence of numerous meal delivery platforms such as Deliveroo.

Delivering home-delivered meals from partner restaurants is an activity that appeals to a wide range of profiles, including students, the unemployed and part-time employees looking to supplement their income. The only prerequisites for becoming a Deliveroo delivery driver are knowing how to ride a bike, being well-equipped and having time to spare. But as a freelancer, you also need a professional status.

How do I become a Deliveroo delivery driver?

To work as an independent delivery driver with Deliveroo or any other home-delivery platform, you'll need a SIRET number. To do this, you first need to choose a professional status and set up your company. Micro-entrepreneur status seems the most appropriate. Free and quick to set up, it allows you to start your business in a very short space of time. Simple to manage, it's the ideal status for trying out a self-employed activity.

The key points of the self-employed delivery driver's micro-business: + Competent CFE: Chambre de Commerce et de l'Industrie + APE code: 5320Z - Other postal and courier activities + Type of activity: Provision of commercial services + Sales ceiling: €70,000 + Rate of social security contributions: 22%.

General conditions of micro-entrepreneur status

Who can become a micro-entrepreneur?

The micro-entrepreneur scheme is accessible to a wide range of profiles. It can be combined with student, salaried or even retired status, allowing you to start your own business with complete peace of mind. However, it is impossible to create a micro-business and become a Deliveroo courier if you are already a company director affiliated to the RSI. The same applies if you are the majority manager of a SARL or EURL, since you are considered a self-employed worker.

On the other hand, a person can only create one micro-enterprise. So, if you already have a micro-business for another activity, you won't be able to create a second one for your bike courier business. However, you can modify your existing business to add your new activity.

What does micro-entrepreneur status entail?

Accounting and returns

The micro-entrepreneur status is a simplified VAT-exempt scheme. You don't need to keep detailed accounts, and a simple receipts/expenditure book is all you need. Invoices must be kept, however. You must declare your sales every month or quarter, depending on the option you choose, even if they are equal to 0.

Please note that while the sales ceiling is €70,000, the VAT exemption ceiling is €33,200. This means that if your sales exceed €33,200, you will have to invoice and declare VAT at the rate of 20% for the provision of services.

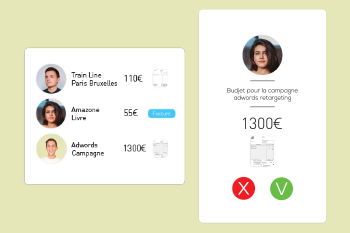

Bank account

Since 2015, it has been compulsory to have a dedicated bank account for any self-employed activity, even as a micro-business. However, this is not necessarily a business account. As remuneration is mainly by bank transfer, an account with a neobank such asAnytime is perfectly suited to your needs.

Taxation

In terms of taxation, micro-entrepreneur status is particularly advantageous for a bike courier business, as it allows you to benefit from a 50% tax deduction on your sales. In plain English, this means that if you earn €10,000 a year as a Deliveroo biker, you're only taxed on €5,000. This deduction is intended to compensate for the expenses incurred in running your business. But you should be aware that in a bike courier business, your expenses are unlikely to represent 50% of your sales.

Insurance

Being a bike courier involves risks for you and other road users. That's why we strongly advise you to take out liability insurance. In principle, as a self-employed worker, you have to pay the premium for this insurance yourself. At Deliveroo, it's just the opposite, as the platform itself, in partnership with Axa, is responsible for this insurance.

Creating a micro-business and obtaining a SIRET number

There's another advantage to opting for micro-business status as a Deliveroo delivery driver: the formalities involved in setting up a business are very straightforward.

You can register as a micro-entrepreneur online or by post. All you need to do is fill in a business start-up declaration form and return it to the CCI (Chambre du Commerce et de l'Industrie) in your département, together with the necessary supporting documents.

You will then receive a SIRET number. This is proof that your company is registered with the RCS (Registre du Commerce et des Sociétés). Once you've received your K-Bis extract, you'll be able to finalize your Deliveroo registration and start your business.

To get your SIRET number quickly and easily, and start your Deliveroo courier business with complete peace of mind, the micro-entrepreneur status is an excellent alternative. Few constraints and great flexibility - that's what's in store for you when you become an independent courier. And if you like your new activity enough to make it your core business, or even to join forces with other couriers, you can also upgrade your company's status.

Anytime offers a professional account with services perfectly adapted to your business.