Start

- Contact our advisors by Chat

-

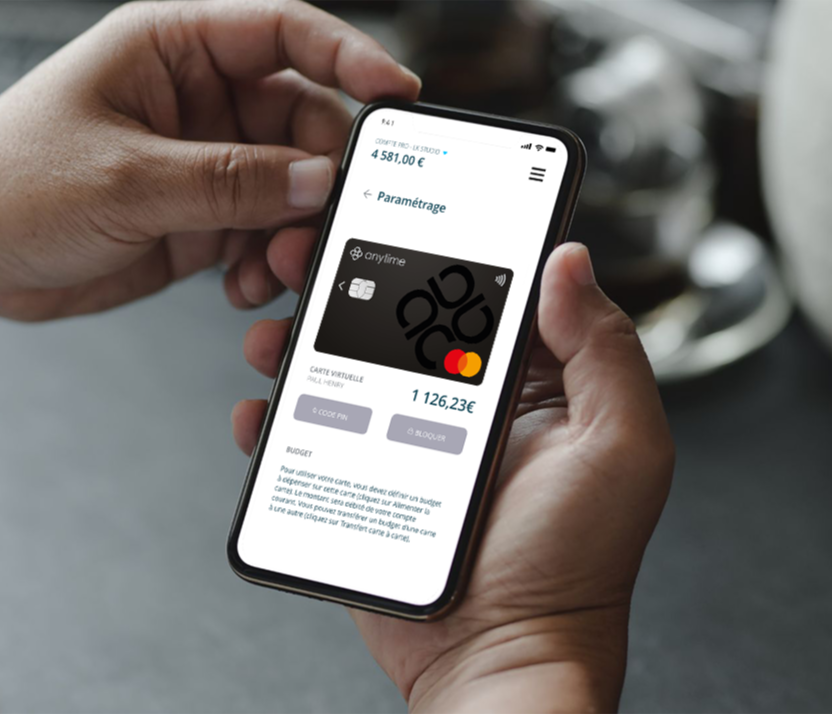

1 Mastercard Professional Classic cardTo find out more about the insurance, protection and limits included with your card, visit https://www.anyti.me/fr/cartes-mastercard-business.

- 1 personal Mastercard

- 20 transfers and direct debits included per month

-

1 free NEW payment terminalMini Smile payment terminal OFFERED by our partner Smile&Pay

- 1 access for you or your accountant

-

Solo legal protection package

Telephone information, commercial defense, criminal defense