The advent of new technologies has brought with it a host of virtual solutions to make everyday life easier for individuals and businesses alike. Among digital companies, FinTechs are developing new financial management and payment options every day. Among the solutions that have emerged in recent years is the Mastercard virtual card, which offers numerous advantages.

How a virtual Mastercard expense card works

What is a Mastercard virtual card?

The Virtual Mastercard Expense Card is a new-generation payment card. It can be used to pay for online purchases, hotel or transport reservations, or supplier invoices.

There are 2 types of virtual cards:

- single-use cards, generated for a single payment

- the recurring-use card, used to pay for subscriptions or recurring transactions of the same amount with a supplier

In both cases, the dematerialized card takes the form of a 16-digit card number (the same 16 digits found on the front of a physical card), a validity date in MM/YY format, and a 3-digit cryptogram. This information is generally communicated to the user via SMS, e-mail or a dedicated application.

How does it work?

To acquire a virtual payment card, nothing could be simpler Simply visit the dedicated application or the bank's website to generate a unique card number. To obtain the number, you need to enter the amount of the transaction.

Since it is generated for a specific amount and is a unique card number, the virtual card offers a level of security. Even if someone were to pirate the card's data, they could never use it for another purchase.

As this is a dematerialized cardIt cannot, of course, be used to pay in a store or restaurant, for example. For physical payments, there is still the possibility of providing a physical corporate card, as you can with theAnytime pro offer.

Why use an e-card for your employees?

A secure and practical solution for online payments

Whether you're booking a hotel for a business trip, ordering supplies over the Internet or taking out a subscription of any kind, the virtual card is the most secure remote payment solution.

Secondly, it saves the employee from having to pay in advance, which is a major advantage. Indeed, an employee's bank account and personal bank card are not always large enough to support business expenses. A trip abroad, for example, can quickly exceed an employee's available budget. Avoiding the need to pay business expenses in advance also avoids the tensions that can be generated by reimbursement delays and various administrative procedures.

The virtual expense card also makes it possible to avoid expense claims. Since there are no more expense claims, there are no more expense reports! And this represents a real saving in time and money for the company.

Please note that this does not mean that receipts are no longer required, as all company expenses must be justified. However, procedures are much simpler.

Ultra-simple management thanks to a dedicated application

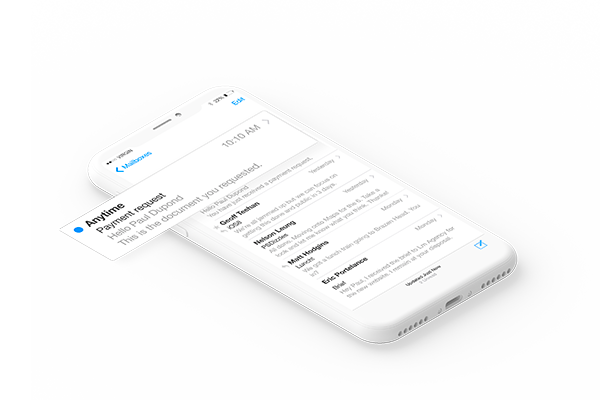

Using a dedicated application to manage your company's virtual cards is an essential time-saver. With a complete solution such as Anytime pro, you can of course benefit from virtual Mastercard cards, but also prepaid cards linked to the same no-banking account, and an intuitive application dedicated to managing your new means of payment.

There are many advantages to using virtual expense cards with management applications.

-

Employees can attach proof of payment in the blink of an eye by taking a photo with their smartphone. There's no risk of losing it, and the finance department can validate the transaction as quickly as possible.

-

The financial manager can monitor all employee expenses in real time. He or she can also modify a card's limit, and even block or unblock it if necessary. Each time a new expense is incurred, he or she receives a notification, and can quickly access receipts to validate the transaction without delay.

- The accounting department can quickly view all transactions and related receipts. This eliminates the need to sort, check and archive documents, as they are all collected and filed using the application. In addition, entry lines can be automatically broken down in the accounting software by incrementing in the right expense accounts. A significant time-saver.

The virtual Mastercard expense card, with its easy-to-use management application, is the most efficient way of managing business expenses available today. Of course, if your employees make a lot of physical payments, it's essential to provide them with physical cards. The corporate cards included in the Anytime pro offer can also be controlled remotely, and function in all respects like virtual cards, giving your employees great freedom of action while allowing you to manage everything simply. With the Anytime bankless account, you can easily manage your employees' business expenses, so you can concentrate on what's most important: growing your business.