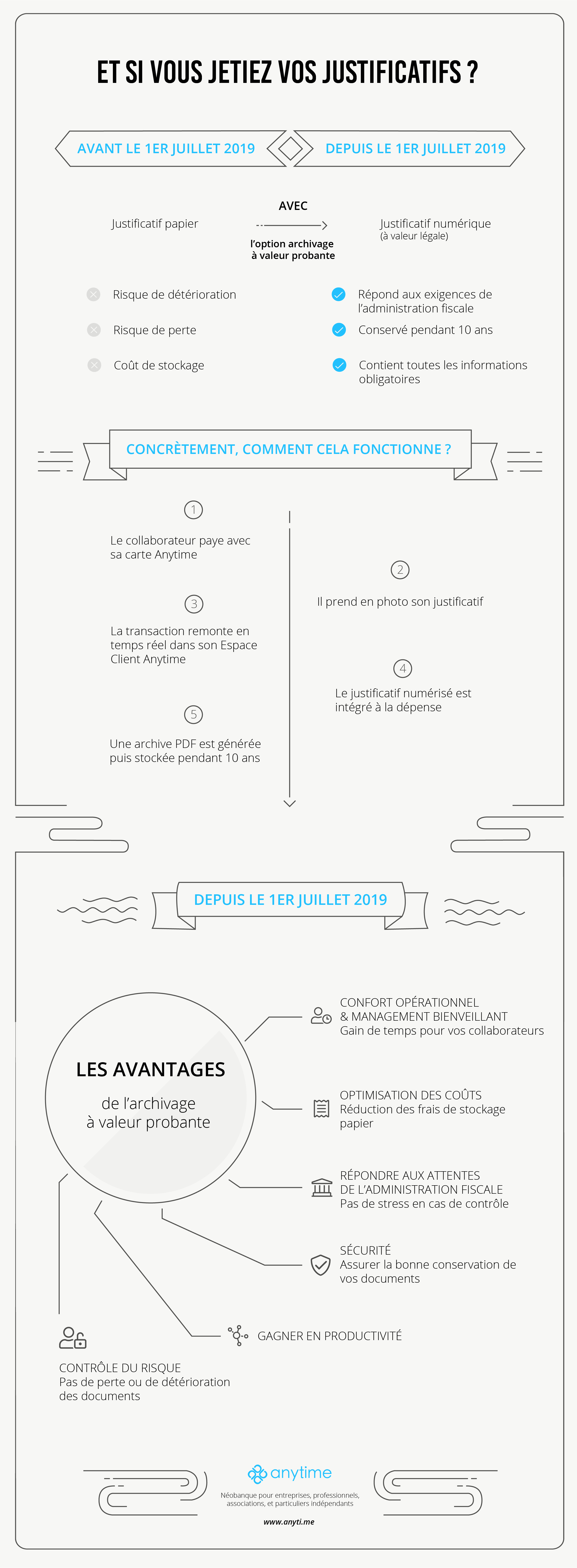

Avant le 1er juillet 2019, vous étiez obligés de conserver vos factures de notes de frais. Mais, depuis cette date, c’est terminé ! Concrètement, grâce à un arrêté du 23 mai 2019 fixant les conditions, il vous suffit de numériser vos justificatifs et vous pouvez ensuite les jeter. Génial, non ?!

Concrètement, comment fonctionne l’archivage à valeur probante?

- Votre collaborateur utilise sa carte Anytime pour régler sa dépense professionnelle.

- La transaction remonte en temps réel dans son espace Anytime.

- Il prend immédiatement en photo la facture ou l’envoie par mail.

- Le justificatif numérisé est intégré dans la ligne de dépense dédiée.

- Une archive PDF est générée garantissant l’intégrité du document (tel que défini dans l’article A 102 B-2 du Livre des Procédures Fiscales).

Ce PDF contient tous les éléments de preuves répondant aux exigences de l’administration fiscale. Stocké sur un serveur sécurisé, le document sera conservé pendant 10 ans.

Quelles sont les garanties en cas de contrôle ?

L’article 16 de la loi de finances rectificative du 29 décembre 2016 (loi n° 2016-1918 du 29 décembre 2016) autorise les entreprises à conserver leurs justificatifs de notes de frais sur support informatique.

Chez Anytime, nous respectons point par point la législation en vigueur. En cas de contrôle, les archives sont donc opposables à l’Urssaf ou au fisc.

L’inspecteur aura dans les mains l’ensemble des informations obligatoires : date, montant, TVA, lieu, historique des actions réalisées sur la note de frais, signature électronique, synthèse des conditions d’archivage…

Avantages

- Vous n'êtes pas stressé en cas de contrôle

- Vos documents numériques sont conservés conformément aux originaux

- L'archivage est sécurisé et centralisé pour une meilleure recherche pendant 10 ans

- Vous n'avez aucun risque de perte ou de détérioration de documents

- Vos collaborateurs vont gagner du temps

- Vous adoptez un management bienveillant

- Vos coûts sont optimisés en réduisant vos frais de stockage papier

Tarifs

2€ par mois et par collaborateur

Pourquoi passer à l’archivage à valeur probante ?

A l'heure du numérique et de la simplification, il est devenu évident pour les entreprises de passer au 100% digital dans la gestion de leurs notes de frais. Même si leur dématérialisation induit une remise en question de la méthodologie, des process et de l'organisation, elle est également à l'origine de nombreux bénéfices. Gain de temps, gain d’espace, gain financier,... La liste est longue !

C’est un arrêté du 23 mai 2019 qui a permis de faire passer la gestion des notes de frais dans une nouvelle ère. Il fixe les conditions de numérisation des pièces et documents établis ou reçus sur support papier, en application de l’article L.243-16 du code de la Sécurité sociale. Il autorise les salariés à jeter les originaux des justificatifs à condition qu’ils soient préalablement numérisés. L’arrêté n’est toutefois pas rétroactif. Il est donc important de conserver les justificatifs antérieurs au 1er juillet 2019.

Garantir la pérennité de l’information

L’archivage à valeur probante donne la possibilité de restitution ultérieure d’information en cas de contrôle.

Concrètement, vous pourrez jeter le papier si vous respectez certains grands principes.

La solution proposée par Anytime remplit à 100% ces 3 principes :

- Authenticité du document : le document archivé doit correspondre au document réel. Toutes les informations figurant sur le document de départ doivent figurer sur la copie numérique.

- Intégrité du document : Le document ne doit être ni modifié ni dénaturé et se doit d’être conforme au document source (documents numérisés sans traitement et sans perte de qualité).

- Intelligibilité du document : le document se doit de respecter les formats imposés par l’administration fiscale (PDF ou PDF A/3 (ISO 19005-3)), afin de garantir sa lisibilité et la pérennisation des données.

Un process simplifié pour le salarié

La plus grande inquiétude des salariés concernant les notes de frais est de perdre la version papier de leur facture.En effet, en cas de perte de reçu, ils ne pourront se faire rembourser. Ce problème est résolu avec l’archivage à valeur probante. Il suffit au collaborateur de prendre sa facture en photo. Sa demande de note de frais est acceptée par son manager. Le service administratif contrôle et valide. Le remboursement est alors déclenché.

Le justificatif de note de frais reçoit alors un cachet serveur garantissant son intégrité. Un PDF est généré et contient l’ensemble des éléments répondant aux exigences de l’administration fiscale.

Au delà du temps gagné par le collaborateur, il n’y a plus de risques de perdre le justificatif.

Un risque de redressement minimisé pour l’entreprise

Les frais sont nécessaires à la vie d’une entreprise. Mais ils n’existent que s’ils sont validés par des justificatifs absolument indispensables. Des justificatifs qui posent souvent problème, car incomplets, perdus, oubliés…!

Il faut savoir que les notes de frais font partie des mouvements les plus surveillés par l’Urssaf. Normal, ceux-ci échappent aux cotisations sociales.

Pour éviter de dépasser le cadre fixé par la législation, mieux vaut être le mieux équipé possible, d’où l’importance de transformer une facture papier en facture numérique à valeur légale et si cela se passe sans aucun effort, c’est encore mieux !

Fini alors le risque de requalification de vos notes de frais par l’administration fiscale.

Bon à savoir : Le dirigeant, quant à lui, doit veiller à bien conserver ses justificatifs. A défaut, en cas de contrôle, le remboursement d’un frais professionnel serait alors requalifié en rémunération et subirait l’imposition qui correspond.

Anytime est à vos côtés dans l’archivage à valeur probante

Chez Anytime, cela fait longtemps que nous sommes convaincus que la gestion des notes de frais est un processus long et douloureux pour les entreprises. C’est d’ailleurs pour cette raison qu’Anytime vous propose une solution complète pour à la fois gérer vos notes de frais de A à Z, mais aussi apporter à vos collaborateur une expérience 100% digitale.

Comment activer l’archivage à valeur probante ?

Accédez à une de vos transactions et rendez-vous sur l’option à activer. Un Chargé de compte vous rappellera pour vous accompagner et pour mettre en place cette fonctionnalité.

Pour en savoir +, n’hésitez pas à contacter l’équipe Anytime