A look back at the origins of Beanstock, with co-founder and CEO Alexandre Fitussi, or how to go from General Manager of Spanish unicorn Glovo, a specialist in multi-category product delivery, to Founder of a successful real estate start-up.

Just after validating his trial period at Glovo, eager to take the step of becoming a homeowner at a time that suited his professional situation, Alexandre began to wonder about the relevance of investing in real estate. He quickly took the plunge, prompting numerous enquiries from friends and family, who were in turn interested in the possibility of investing in real estate.

"I started by buying two small apartments in the 17th arrondissement and renting them out. The experience went very well, and I quickly got the hang of it. Faced with the many requests for advice, I realized that assisting people with an investment was a full-time job: indeed, any assistance represents a long process. Each person reacts in a very personal way to this kind of investment: the quick, the undecided, the reluctant... you have to take your time with everyone, but that's how it all started!"

In parallel with this first indirect experience in rental investment support, Alexandre met at Glovo what he describes as his professional soulmate, Emma Malha, fresh out of HEC. They worked together at the Spanish unicorn for 3 years, before embarking on the Beanstock adventure.

"We realized that the rental investment market was gigantic, with a huge number of transactions, a huge amount of interest, but above all too many people who were sitting on the sidelines, scared off by the sight of a figure or the mention of a rate of return; both the operational and financial aspects are frightening.

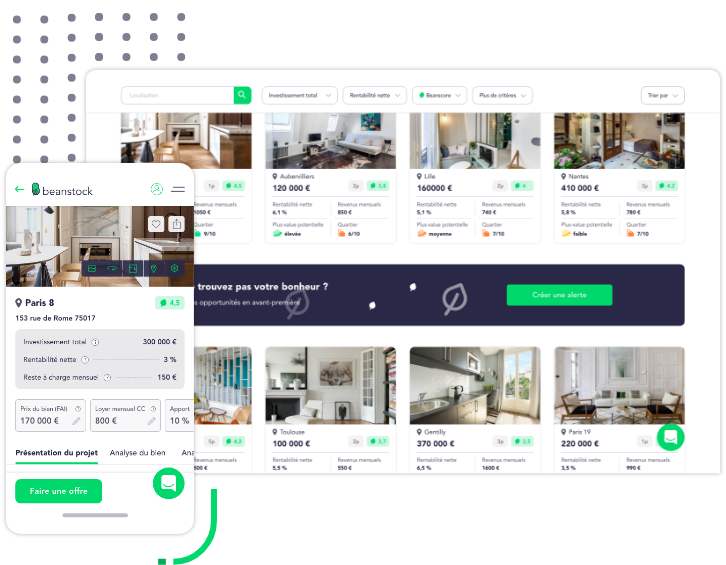

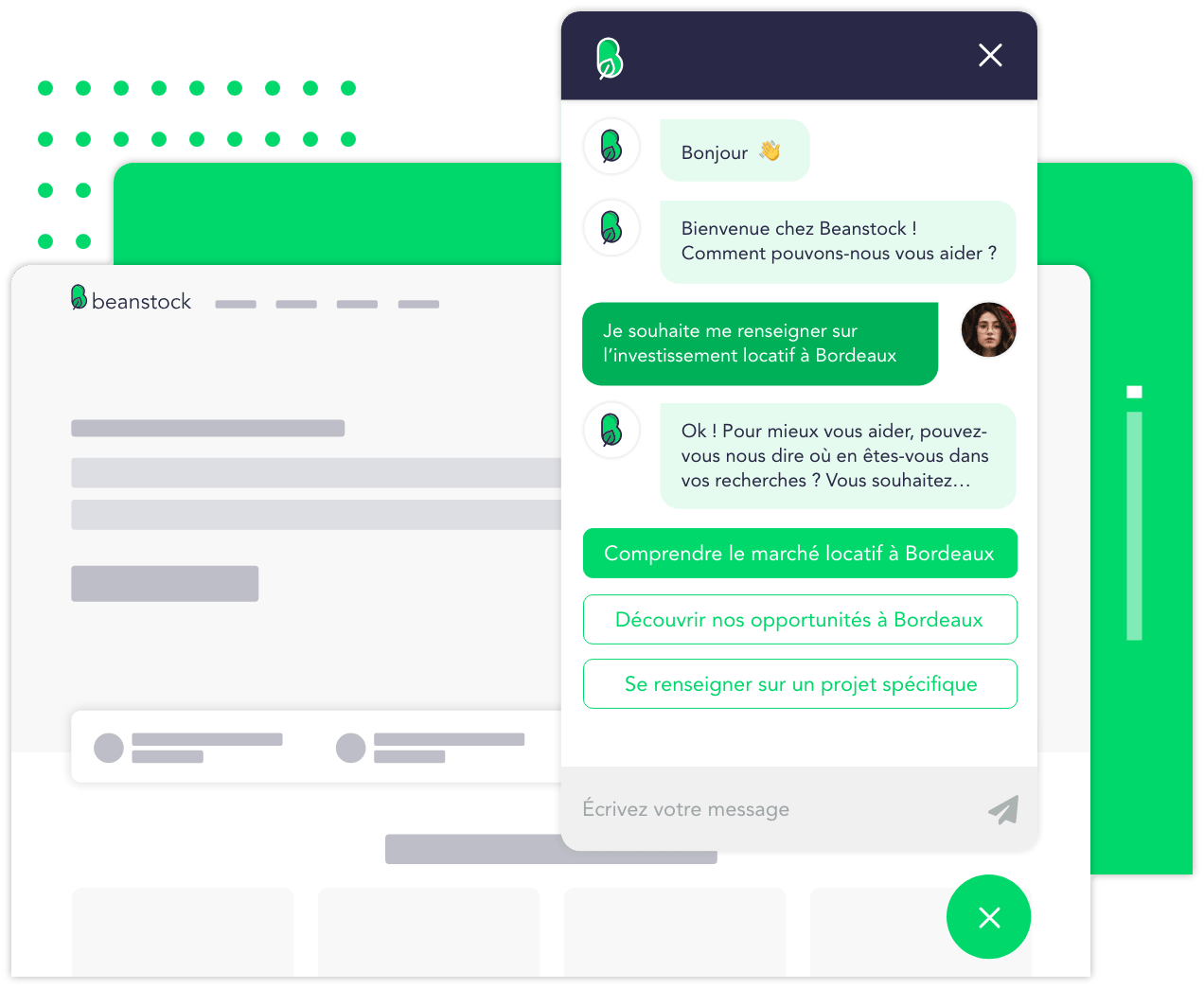

So we asked ourselves if it was possible to solve this problem with a scalable company, as digital as possible, integrating all stages of the process according to the customer's wishes: finding the property, obtaining credit, post-purchase support with work, refurbishment as well as support for renting and managing this rental."

This is how the Beanstock adventure was launched. In addition to providing properties and dedicated support, Alexandre wanted investors to be able to delegate the rental of their property as much as possible.

"Once the customer has identified a project that suits them, we start by checking that they are in a position to finance it. We work with banking partners, enabling us to check the customer's solvency and eligibility for the loans needed to proceed. Once this stage has been validated, we hold an initial meeting with the customer to ensure that he or she is fully aware of the ins and outs of the project.

Secondly, we offer the customer support in renovating the property. And finally, once the property has been renovated, we take care of finding a tenant.

Our challenge is that our customer receives his first rent 4 months after identifying a suitable property."

Beanstock 's ambition is even to be able to continue to support a buyer in the resale of his property, once his profitability targets have been reached.

"We act as a guarantee for property managers in these times, as well as for the investor, and the handover is very reassuring for both parties involved.

The real issue for anyone hesitating to take the plunge is "how to convince people to invest". We see a lot of people who are very interested at first, but become disengaged as the process progresses.

Someone who creates an account doesn't buy the next day. We're aware that we're in a long cycle, but it's up to us to get customers to approach it in a more serene way. We have many more subscribers than expected, and now we need to help them get through the transition.

In the quest for profitability, basic criteria are bound to evolve, and it may be necessary to sacrifice a view, elevator access, etc., and it takes time for people to understand and accept this.

"You have to strike a balance between quality and profitability. If we take the example of a property in Pau at 19% profitability, let's face it: finding a tenant in Pau will be much more complex than in Paris, and the same goes for putting the property up for sale or developing it. We need to be able to take into account the emotional side of future investors when buying real estate, so that it doesn't override the decision-making process and we can present the financial concepts."

Beanstock only presents the buyer with data that is processed during the support process, in the decision-making process, and subsequently throughout the investment process.

"To take a concrete example, when a homeowner has to deal with a water leak, with all that this can represent in terms of administrative irritation, with us, our customer won't hear about it until the leak problem has been resolved."

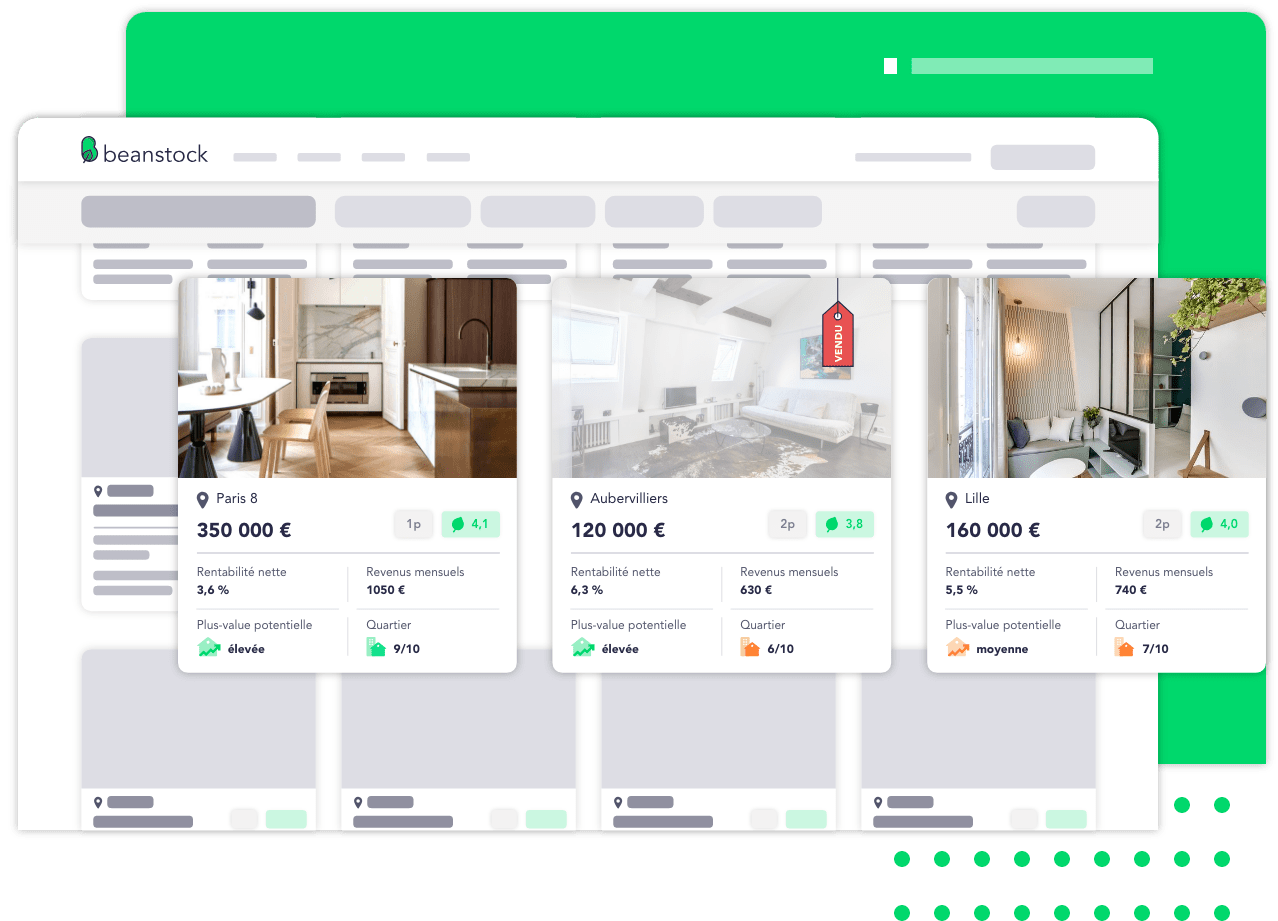

The goods listed on the Beanstock website have their own metric, called " beanscore ", and we asked Alexandre what this concept was all about.

"We wanted to provide the customer with a note that summarizes our opinion of the property, so that they understand the characteristics that enable us to evaluate it in a particular way. From a list we've drawn up, we highlight one or other criterion to characterize the property. We guarantee a 100% occupancy rate with a tenant.

Obviously, depending on the property's location, the potential value varies: for example, an apartment in the 15th arrondissement of Paris bought at €8,000/m2, even if it's not profitable in terms of rental income, is a superb investment, with the added value assured on resale."

Blindly announcing a rate of return to a customer won't speak to him, but if he is presented with the average rate of return for the area and his property is twice the average rate, the customer is faced with digestible data.

"In the future we want to make this metric a clear and understandable reference for customers.

Our primary philosophy is democratization, both for first-time buyers and for those who think this kind of investment is no longer for them.

Today's 25-35 year-olds are part of our core target group, because they are the ones who impose the most restrictions on themselves and who remain on the sidelines of the market. We want to put them back at the heart of the real estate game. 80% of our customers are first-time buyers.

To discover the solution click here