Contrairement aux générations précédentes, notre carrière ne sera pas linéaire. A 30 ans, il est commun d'avoir déjà changé d'entreprise ou de statut professionnel.

La vision de Caravel : tous les parcours professionnels doivent permettre d’avoir une retraite. Nos choix professionnels ne doivent pas être dictés par la peur de l'avenir.

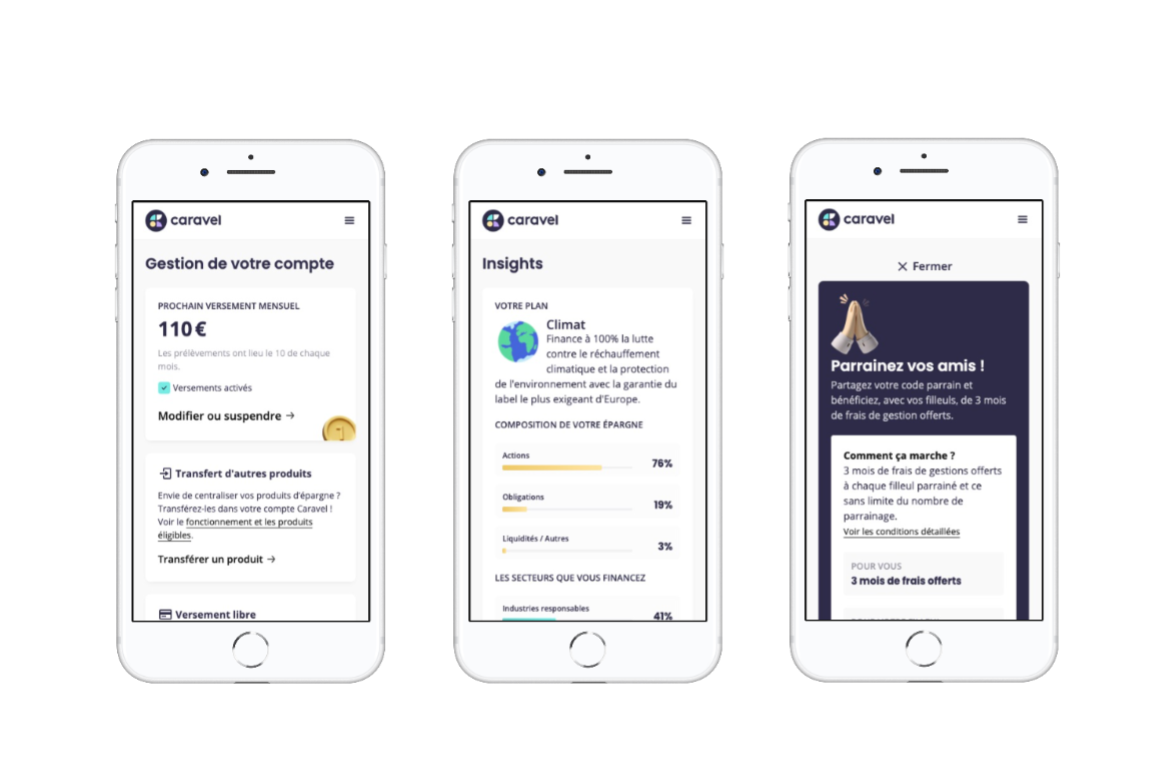

Caravel a donc créé la retraite complémentaire qui permet aux indépendants de financer leur avenir, dès aujourd'hui. Adaptée à chaque profil, d’une simplicité déconcertante, la retraite avec Caravel est ajustable et responsable.

Quels sont les avantages ?

- Un compte pension flexible qui s’adapte à vous. 🤸

Les versements sont libres, flexibles, ajustables en un clic depuis votre espace personnel et cela sans frais. - Un compte pension qui permet d'agir pour le monde de demain en profitant dès aujourd'hui. 🎉

Vos versements sur votre compte vous permettent de réduire votre impôt sur le revenu. - Vous financez des causes à impact sans sacrifier vos performances financières. 🌱

Les fonds sélectionnés sont labellisés Greenfin et Finansol, c'est-à-dire qu'ils financent des projets en faveur du développement durable et la solidarité. - Nous vous accompagnons jusqu’à votre retraite. 👨👩👧👧

Vous avez la main mais nous sommes là quand vous en avez besoin : en cas d’évolution de statuts professionnels, d’emploi, de situation familiale… - Un compte pension au service de vos projets de vie. 🏠

En cas de projets importants ou de coups durs, votre épargne est déblocable de manière anticipée (achat résidence principale, fin droits chômage,...).

Quelle est la différence avec une assurance-vie ?

Il s'agit de 2 enveloppes de placements différentes, et qu'il ne faut pas forcément opposer.

Ce sont deux produits d'épargne qui peuvent être complémentaires.

Les principales différences concernent la fiscalité et les conditions de sortie.

Avec le PER (Plan Epargne Retraite), vous pouvez déduire dès la signature de vos contrats, les montants placés de votre revenu, ce qui n'est pas le cas avec une assurance-vie.

Si l'argent placé sur un compte épargne retraite peut être utilisé avant la retraite, les conditions de déblocage sont différentes de celles de l'assurance-vie.

Quel est le type de contrat souscrit au travers du compte pension Caravel ?

Le compte pension Caravel est un PER Individuel assurantiel.

Il fonctionne à la manière d'une assurance-vie multisupport, et offre la possibilité d'investir dans un fonds euro (dans lequel le capital est garanti) et des unités de compte sur les marchés financiers (fonds d'investissement risqués).

Il vous permet d'économiser pendant votre vie active pour obtenir à partir de l'âge de la retraite un capital ou une rente. Il fonctionne donc en deux temps :

1. Une phase d'épargne (dite de constitution des droits) : c'est la période pendant laquelle vous cotisez en faisant des versements réguliers.

2. Une phase de rente (dite phase de liquidation des droits) : qui intervient à partir de l'âge de la retraite sous certaines conditions de versement en capital, ou avant selon certaines conditions décrites plus bas.

Quels documents dois-je fournir à Caravel ?

Pour souscrire au compte épargne retraite Caravel, vous aurez besoin :

-

D'un document d'identité (carte d’identité, passeport ou titre de séjour en cours de validité)

- D'un justificatif de domicile (Factures internet, téléphonie fixe, eau ou électricité)

Et c'est tout ! En plus la signature du contrat se fait en ligne.

Comment ça marche ?

- Ouvrez votre compte pension en quelques minutes, gratuitement et sans paperasse. 🏃

- Alimentez votre compte pension : vous définissez vos versements librement ou de manière programmée. 💰

Modifiez-les à tout moment, sans frais, depuis votre espace.

Vous pouvez également transférer les fonds de vos anciens contrats retraite (PERP, PERCO, Madelin, ...) - Chaque année, déduisez les montants versés de votre revenu imposable. 📊

- Votre épargne est investie en accord avec votre plan sur des supports d'investissements durables.

- Votre argent travaille pour vous. Caravel fait opérer la magie des intérêts composés. Vous pouvez suivre son évolution depuis votre espace personnel, l’optimiser ou l’arrêter à tout moment. 🕹️

- Récupérez votre argent lors de votre départ à la retraite, ou bien avant si besoin, pour l'achat de votre résidence principale, ou en cas de coups durs. 💶

Notre offre partenaire ?

Lors de votre ouverture de compte, indiquez le code ANYTIME, vous bénéficierez de 3 mois de frais offerts ! 🎁

(Les frais sont appliqués par trimestre, cela revient donc a un trimestre complet offert.)