En tant qu'indépendant, s'occuper de la comptabilité de sa société est primordial, mais peut être une tâche complexe et chronophage. C'est pourquoi Anytime a décidé de vous donner un coup de pouce en s'associant à Indy, une application intuitive qui automatise votre gestion comptable.

Avantages 💯

🎯 Une solution conçue pour tous les indépendants : professionnels de santé, freelances, autres professions réglementées, ...

💰 Des tarifs clairs, accessibles et transparents : 20 fois plus rapide qu'un logiciel traditionnel et 4 fois moins cher qu'un expert-comptable

🤖 Une catégorisation intelligente et automatique des transactions

🔏 La clôture fiscale sans effort avec l’aide du logiciel et du service client

👌 Un abonnement sans engagement

🔥 Une superbe offre pour les clients Anytime !

Tarifs 💸

- Pour les professions libérales soumises à l'impôt sur le revenu, l'offre est de 20€ HT/mois,

- Pour les sociétés soumis à l'impôt sur les sociétés, l'offre est de 49€ HT/mois

À savoir : les frais professionnels sont déductibles 💡

Client Anytime ? Vous bénéficiez d'une offre partenaire, découvrez la depuis votre Espace client👤

Qu'est-ce que cette solution peut vous apporter ? 🎁

Synchronisation et rapprochement bancaire automatique 💳

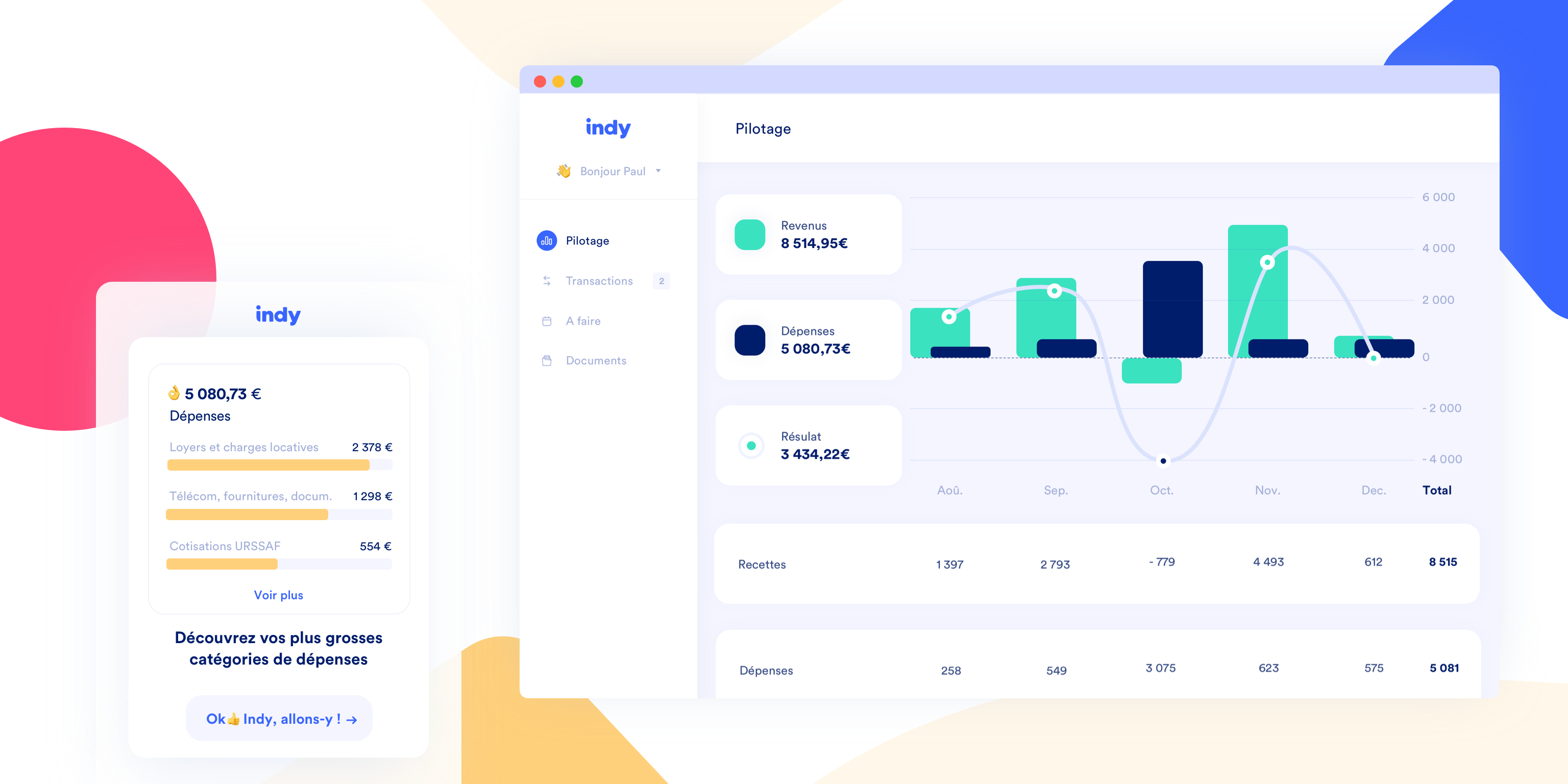

Votre compte Indy et votre compte Anytime sont automatiquement synchronisés, fini les saisies manuelles et les erreurs de solde bancaire ! Vos dépenses et recettes sont transmises automatiquement et en toute sécurité à Indy, et vous êtes assuré de tenir une comptabilité sans erreur.

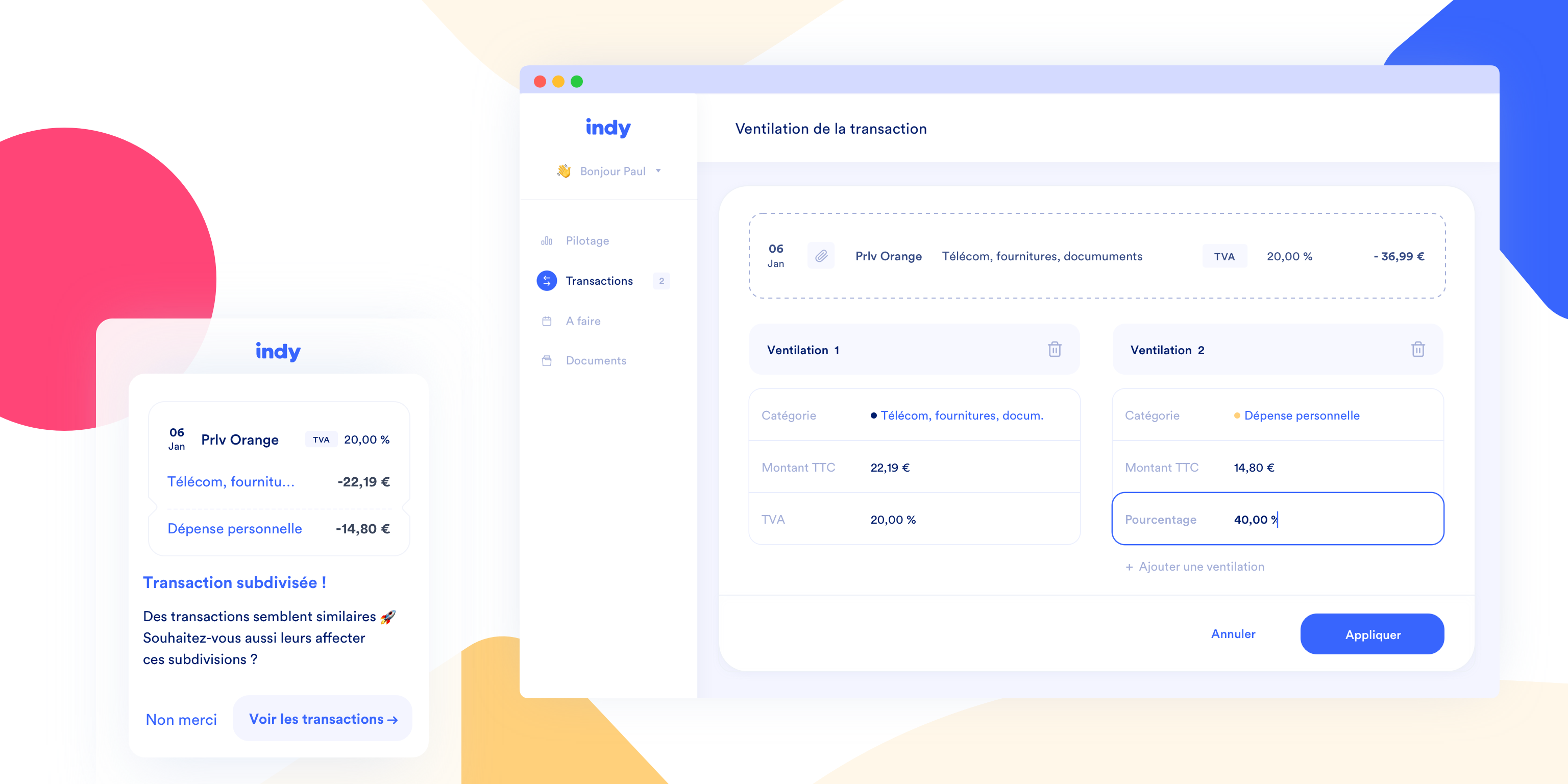

Catégorisation et ventilation automatique 🧮

Grâce à l'intelligence artificielle, plus de 90% des transactions sont classées de manière automatique ! De plus, vous pouvez ventiler les transactions ou ajouter des notes de frais en deux clics, grâce à une interface pensée pour des non-comptables.

Auto-complétion de vos déclarations 📝

Chaque année vous passez plusieurs jours sur votre clôture fiscale ou votre bilan ? Avec Indy c’est de l’histoire ancienne ! Suivez pas à pas les étapes et validez sereinement vos déclarations. A chaque étape, Indy génère les écritures comptables nécessaires à votre clôture.

Déclaration de TVA automatisée 📊

Indy vous simplifie la vie et vous débarrasse des formalités de TVA. Le logiciel applique automatiquement le bon taux de TVA à vos dépenses et recettes en fonction de la catégorie de transaction. Il vous guide ensuite pour remplir votre déclaration de TVA.

Génération de vos liasses fiscales et bilans et télétransmission de vos déclarations 🧳

Vos diverses déclarations (fiscales, TVA, Honoraires versés, ...) sont générées directement par Indy et télétransmises depuis le logiciel. Les documents de votre bilan sont eux aussi générés par Indy et disponibles au téléchargement en cas de besoin.

Concrètement, comment souscrire ?

- Rendez-vous dans votre Espace Client 👤 dans la rubrique Comptabilité

- Sélectionnez le logiciel comptable Indy 🙋♂️

- Vous êtes alors redirigé sur le site de notre partenaire Indy, vous complétez vos informations📝

- Vous choisissez ensuite Anytime parmi dans le sélecteur de banque ✅

- Synchronisez votre compte Anytime avec Indy en vous connectant avec vos accès Anytime 🔐

- Votre comptabilité est automatisée et votre vie professionnelle simplifiée ! 😄