Un autoentrepreneur est soumis à l’obligation de facturer ses services. La facture est un document spécifique qui doit respecter certaines conditions pour être légalement valable. Voici les informations à connaître pour facturer en micro-entreprise dans les règles de l’art.

Quand faut-il établir une facture ?

Le micro-entrepreneur, comme tout professionnel, est en principe tenu de délivrer à ses clients une facture à l’occasion de chaque vente ou prestation de services. Il existe cependant des nuances à connaître. La facture est obligatoire dans le cadre d’un échange entre professionnels car elle constitue une preuve juridique et sert de justificatif en comptabilité.

Au cours d’opérations avec des particuliers, la facture n’est nécessaire que dans le cadre des ventes à distance ou si le client la demande, et ce, quel que soit le montant de la transaction. D’autre part, il existe des cas où l’établissement d’une note est obligatoire : + une prestation de services comportant l’exécution de travaux immobiliers, avec ou sans vente + si le montant de la prestation est égal ou supérieur à 25 euros.

À noter qu’une note n’est pas une facture. En effet, les mentions obligatoires sont moins nombreuses sur la note.

Règles de base de la facturation en auto entreprise

Lorsque vous facturez, vous devez veiller à respecter un certain nombre de règles. + Le document doit être transmis au client le jour de la livraison du produit ou de l’exécution de la prestation. Le retard maximum admis est de 15 jours. + Après émission, une facture ne peut pas être retouchée ou annulée par l’autoentrepreneur. En cas d’erreur, il faut faire un avoir du même montant et éditer une nouvelle facture comportant les bonnes informations. Néanmoins, si le client apporte des modifications, l’autoentrepreneur peut les accepter. + La facture doit être établie en 2 exemplaires minimum : l’un remis au client et l’autre conservé par l’autoentrepreneur comme justificatif de son chiffre d’affaires. + Un système de numérotation logique doit être respecté, les numéros doivent être uniques et se suivre. Outre ces règles de bonne conduite, il est important de faire figurer un certain nombre de mentions indispensables.

Les mentions obligatoires d’une facture

Identification de l’entreprise et du client

Une facture doit porter tous les éléments permettant d’identifier clairement l’auto-entrepreneur, à savoir : + ses nom et prénom + son adresse + son nom commercial le cas échéant + son numéro de SIRET + son numéro d’identification au Registre des Commerces et des Sociétés ou au Registre des Métiers le cas échéant.

Le client doit être identifié par son nom, son adresse et sa forme juridique s’il s’agit d’un professionnel.

Listing des produits ou services vendus

Une liste précise des produits ou prestations vendus doit figurer sur la facture. + La dénomination de chaque article ou service. + La quantité vendue. + Le prix unitaire HT et le total HT pour chaque lot d’articles. + Les éventuelles réductions appliquées. Celles-ci doivent apparaître au niveau de la ligne concernée, ou avant le total global s’il s’agit d’une remise sur l’intégralité de la transaction.

Informations de paiement

La transaction est encadrée par de nombreuses règles, notamment des délais de paiement. Pour que la facture soit juridiquement valable en cas de litige, celle-ci doit comporter : + la date d’émission + la date de livraison ou d’exécution de la prestation + la date de règlement prévue + le taux de pénalités en cas de retard de paiement, si celui-ci est différent du taux légal. À noter qu’il ne peut dépasser le triple du taux légal, et qu’il doit être indiqué dans vos conditions générales d’utilisation et de vente. + les conditions d’escompte. Si elles sont prévues par vos CGU, les conditions d’escompte définissent une réduction en cas de paiement en avance par rapport à l’échéance. + le montant forfaitaire fixé par décret pour toute facture impayée dans le cadre d’une relation B2B. « En cas de retard de paiement, indemnité forfaitaire légale pour frais de recouvrement : 40 €, article D.441-5 du Code de commerce ».

Il est également recommandé de noter le mode de règlement prévu pour la transaction, par exemple : + règlement par chèque à l’ordre de… + règlement par virement à l’ordre de… IBAN…

Mentions supplémentaires

Selon votre situation, d’autres mentions obligatoires doivent apparaître sur votre facture. + Si vous êtes micro-entrepreneur du bâtiment ou artisan, vous devez souscrire une assurance décennale. Vous devez alors indiquer sur la facture les nom et adresse de l’assureur et du garant, et l’étendue géographique de la protection. + Quelle que soit votre activité, si vous avez souscrit à une assurance RC Pro (Responsabilité Civile Professionnelle), vous devez indiquer les informations relatives à l’assureur. + Si pour votre comptabilité vous adhérez à un Centre de Gestion Agréé, apposez la mention « membre d’une association agréée, le règlement par chèque est accepté ».

Facturation et TVA

TVA non applicable

En dessous de certains seuils, la facture d’un autoentrepreneur ne doit pas faire figurer la TVA. À ce titre, chaque facture éditée avant d’atteindre le plafond de franchise de TVA doit porter la mention : « TVA non applicable, art. 293 B du CGI ». Le total de la facture est donc exprimé en HT et l’autoentrepreneur n’a pas à se soucier des taxes.

TVA devenue applicable

Depuis début 2018, les plafonds de chiffre d’affaires des micro-entreprises ont été relevés pour être fixés à 70 000 € pour les services et 170 000 € pour la vente de marchandises. Cependant, les plafonds de franchise de TVA n’ont pas été relevés et restent donc respectivement à 33 200 € et 82 800 €.

Cela signifie que si vous dépassez, au cours de l’année, le seuil de franchise de TVA, vous devrez alors éditer des factures avec TVA. Vous devez donc retirer la mention « TVA non applicable, art. 293 B du CGI » et informer le SIE (Service des Impôts des Entreprises) dont vous dépendez par lettre suivie ou recommandée.

À noter que si vous dépassez le seuil de franchise de TVA, il vous faudra alors choisir un régime de TVA : un régime réel simplifié avec une seule déclaration à l’année, ou un régime réel normal avec une déclaration trimestrielle ou mensuelle selon votre chiffre d’affaires.

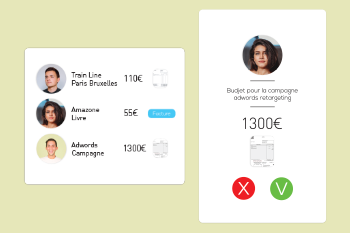

La facturation n’est pas une mince affaire et s’y lancer sans en maîtriser les différents aspects peut amener à faire des erreurs lourdes de conséquences. Pour éviter cela, vous pouvez utiliser un modèle préétabli, ou bien utiliser le logiciel de facturation qui est intégré à Anytime et qui répond à toutes les obligations légales.