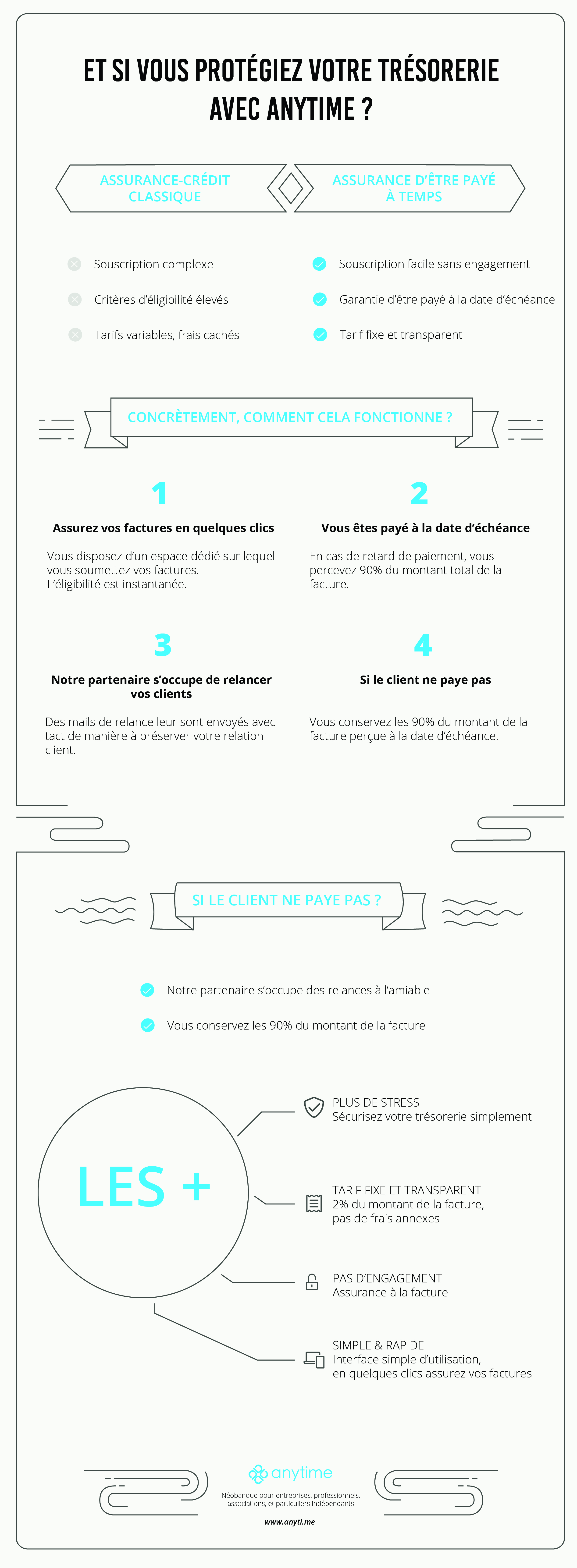

Vous sentez-vous anxieux face au retard de paiements ? 87% des dirigeants de PME répondent oui. Mais les recours classiques pour se protéger ne sont pas adaptés à vos besoins : trop complexes, trop coûteux et des critères d’éligibilité trop élevés. Anytime a trouvé la solution en s'associant à Dimpl, le service d’assurance à la facture.

Tarifs

Dégressifs en fonction du volume (de 1,2% à 3% sur le montant HT, sans frais supplémentaires).

Comment cela fonctionne ?

- Créez un compte Anytime

- Vous disposez de factures

- Assurez la/les facture(s) de votre choix avec notre partenaire Dimpl

- En cas de retard de paiement, vous percevez 90% du montant de la facture à la date d’échéance.

- Vous toucherez les 10% restant lorsque le client règlera la facture.

Que se passe-t-il si le client ne paye pas ?

Si le client ne paye pas, vous conserverez 90% du montant de la facture.

Pour les relances, ne vous en occupez plus, notre partenaire s’en charge pour vous.

Avantages

- Plus de stress, sécurisez votre trésorerie

- Pas d’engagement : pas de rendez-vous physique, ni de papiers et d’informations difficiles à avoir, vous utilisez le service lorsque vous le souhaitez

- Une interface simple d’utilisation. Pas de relances à faire aux clients, vous gardez constamment un œil sur votre trésorerie

- Pas de surprise : Tarif fixe et transparent. Vous payez le service lorsque vous touchez votre argent.

Pourquoi vous prémunir contre les retards de paiements ?

Véritable menace pour les PME, le retard de paiement est responsable de 25% des faillites. Contrairement aux grandes entreprises, un trou dans la trésorerie de quelques milliers d’euros peut engendrer des conséquences importantes sur votre activité : impossibilité de payer ses fournisseurs, difficultés à payer les salaires…Il est donc primordial de vous en protéger. C’est pourquoi Anytime vous propose un service sans engagement, simple d’utilisation et sécurisant. Votre client ne peut pas payer à la date d’échéance ? En un clic, recevez votre argent et sécurisez votre trésorerie. Finis l’incertitude concernant la date du paiement.

1. Plus de stress, sécurisez votre trésorerie

Ne craignez plus les factures impayées ! Vous êtes sûrs de voir vos créances assurées recouvertes.

À la date d’échéance, en optant pour ce service, vous êtes garanti de recevoir90% du montant de votre facture sous 48H. Les 10% restants vous seront versés lorsque le client paiera.

L’avenir étant incertain, en cas de défauts de paiement vous conservez les 90% du montant de la facture.

Contrairement à d’autres services similaires, gardez le contrôle sur les factures impayées et la relation client jusqu’à la date d’échéance. Ce n’est qu’à partir de celle-ci, que les équipes prennent le relais.

2. Un service sans engagement

Avec son service à la facture, plus besoin de s’engager. Un besoin de visibilité sur la trésorerie ? Un doute sur le recouvrement d’une créance ? Soyez flexible.

Souscrivez facilement au service. Finis les tonnes de papiers, finis les rendez-vous interminables…il suffit de quelques clics. À partir d’une interface dédiée, vous déposez les factures que vous souhaitez assurer. L’éligibilité de la facture (*) est alors directement vérifiée par les équipes afin que vous obteniez une réponse immédiate. Pas de devis, pas d’attente.

3. Simplifiez votre vie professionnelle

Ne perdez plus votre temps à courir après les clients retardataires, notre partenaire s’en occupe. Il se charge de les relancer à l’amiable. Ces mails de relance peuvent être à votre guise envoyés de votre boîte mail professionnelle pour vous garantir un contrôle total ou entièrement délégués.

Améliorez la visibilité sur votre trésorerie. Grâce à notre service garantissant le paiement à échéance, anticipez les flux d’entrée et de sortie de toutes les créances. Ce n’est donc plus la peine de spéculer, vous êtes en mesure d’anticiper. Toujours dans l’optique de protéger votre trésorerie, le coût du service n’est prélevé que lorsque vous recevez l’indemnité ou le paiement du client.

4. Assurez vos factures impayées à prix fixe

Cette offre propose un tarif dégressif et transparent allant de 1,2 à 2% du montant HT par facture à recouvrir. Un tarif sans surprise : Pas de devis, pas de frais supplémentaires !

Anytime à votre service pour protéger votre trésorerie

Vous aider à mieux gérer votre compte professionnel passe aussi par protéger votre trésorerie. C’est pourquoi Anytime vous accompagne pour vous assurer contre les retards et défauts de paiement.

Les questions que vous pouvez vous poser

1. Pourquoi faut-il assurer la facture 10 jours avant l’échéance ?

Ce service vous permettant d’assurer votre facture contre un retard potentiel, il est nécessaire que celle-ci ne soit pas déjà en retard. Les 10 jours correspondent au délai de carence de notre partenaire assureur.

2. Que se passe-t-il en cas de défaut du client ?

Si votre client ne vous paye pas, vous conservez les 90% versés par notre partenaire à titre d’indemnité d’assurance et nous fermons le dossier.

3. Au bout de combien de temps vais-je recevoir l’indemnité ?

À partir de la date d’échéance d’une facture, vous pouvez demander le versement de l’indemnité depuis votre profil créé sur l'interface de notre partenaire. Celle-ci apparaît sur votre compte bancaire 48 heures après la demande.

4. Quels sont les critères d’éligibilité ? Est-il possible d'assurer une facture pour une société à l'étranger ?

Notre partenaire assure les factures entre sociétés en France. L’éligibilité est basée sur le score de risque des sociétés.

5. Quelle est la différence avec une agence de recouvrement ?

L’indemnité versée à l’échéance offre une garantie de trésorerie à hauteur de 90%, ce qui n’est pas le cas des sociétés de recouvrement. Les sociétés de recouvrement peuvent être complémentaires en cas de factures déjà échues mais leurs frais sont généralement beaucoup plus élevés.

6. Au bout de combien de temps vais-je recevoir l’indemnité ?

A partir de la date d’échéance d’une facture, vous pouvez demander le versement de l’indemnité. Celle-ci apparaît sur votre compte Anytime, 48 heures après la demande.