Opter pour une application mobile pour la gestion des notes de frais est un moyen sûr de se simplifier la tâche et de gagner du temps, surtout lorsque les salariés sont mobiles. Mais pour cela, encore faut-il choisir la solution la mieux adaptée. Voici les applications les plus appréciées, de la moins complète à la plus aboutie.

Les critères de choix d’une solution de gestion des notes de frais

On se focalise généralement sur le prix et le nombre de fonctionnalités pour choisir une solution de gestion des notes de frais. Ce sont certes des facteurs importants mais loin d’être les seuls à prendre en compte. D’autres méritent tout autant d'attention, à commencer par :

- l’ergonomie de l’outil,

- la flexibilité du paramétrage,

- la dématérialisation des justificatifs à valeur probante (Urssaf et Fisc),

- la possibilité de procéder aux exports des écritures vers un logiciel comptable par intégration de fichiers plats (CSV, Excel, mail, FTP ou API)

- la compatibilité avec les logiciels de paie

- ou encore la possibilité d'exporter uniquement les frais de mission devant figurer à la DSN.

1. Anytime

Le compte pro en ligne Anytime vous propose une solution parfaitement complète. En plus de l’application dédiée qui permet de tout gérer en un claquement de doigts, Anytime met à votre disposition des cartes matérielles et virtuelles permettant à vos salariés de régler leurs dépenses professionnelles.

Les référents sont notifiés des dépenses en temps réel et peuvent, en cas de besoin, bloquer ou débloquer une carte ou en modifier le plafond. Les justificatifs sont intégrés dans l’application à partir des photos prises avec smartphone et toutes les informations peuvent, bien sûr, être transférées directement vers un logiciel comptable.

Coût :

Sur devis uniquement pour les besoins en cartes supplémentaires à 10 cartes.

Pour les indépendants ou les petites structures, les forfaits "Compte pro au quotidien" à partir de 9,50€/mois peuvent également être très intéressants.

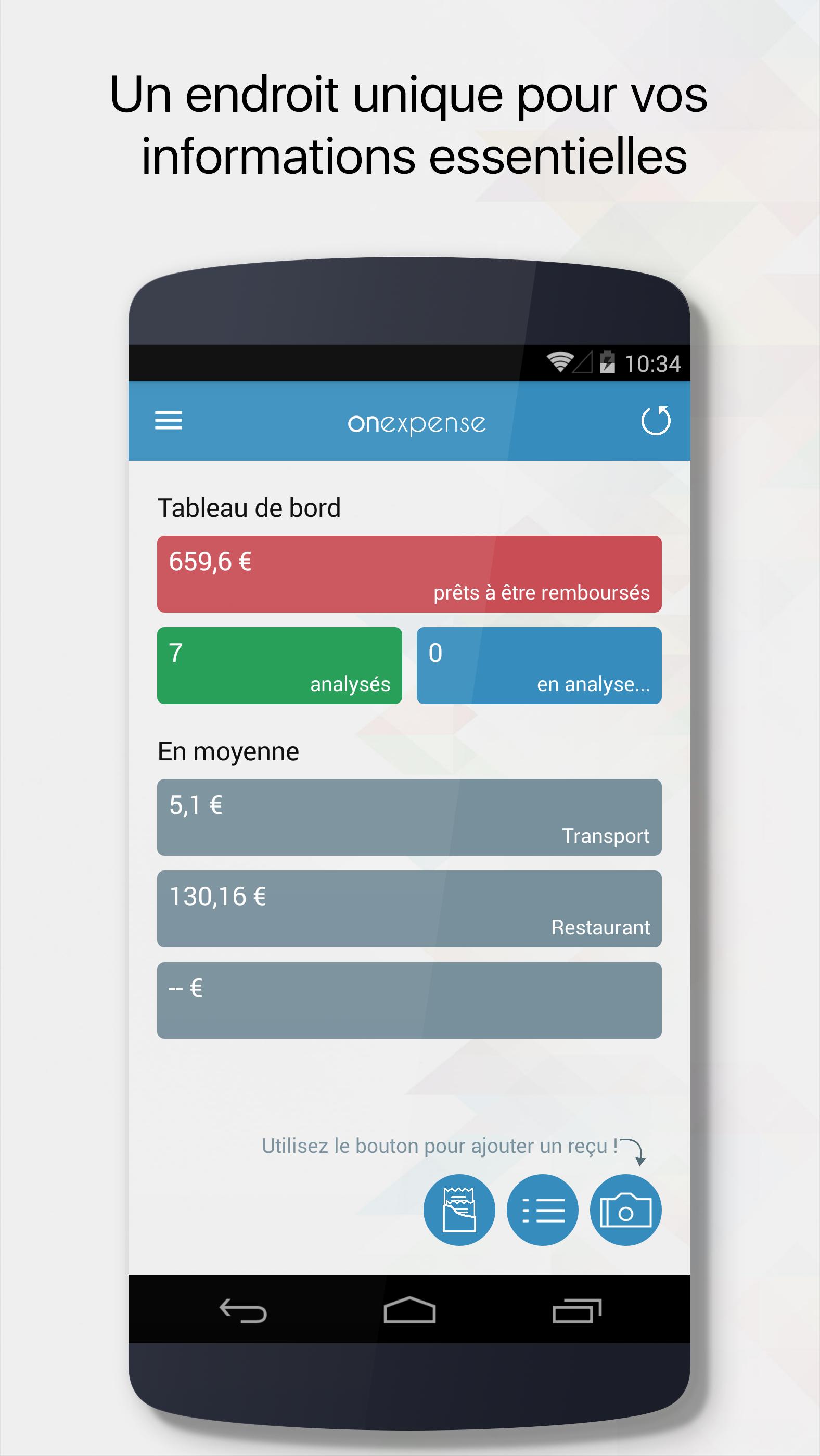

2. Onexpense

Onexpense est une application de gestion de notes de frais française paramétrée pour prendre en compte les différents postes de dépenses des salariés, y compris les frais kilométriques. Pour fonctionner, le salarié doit scanner les factures et les tickets de caisse depuis son smartphone. L’application se charge ensuite de ventiler les opérations en fonction du taux de TVA et du type de dépenses.

Avant d’être transmises au service comptable, les informations sont synthétisées. Elles peuvent également être extraites sous différents formats de fichier.

Coût : application gratuite jusqu’à 50 opérations par mois, puis sur devis.

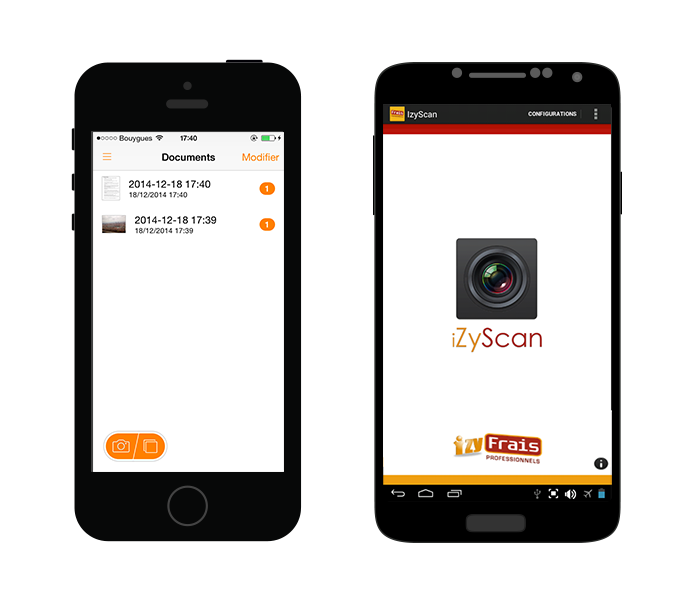

3. iZyFrais

iZyFrais est une plateforme française 100 % digitale. Les justificatifs de dépenses sont décodés par l’outil iZyScan, puis classés dans votre espace personnel. Pour valider la demande de remboursement de frais professionnels, le manager doit simplement l’approuver depuis l’application. iZyFrais facilite également le transfert des informations vers le logiciel comptable.

Coût : 3 mois gratuits, puis 9 € par mois pour 12 à 15 justificatifs scannés.

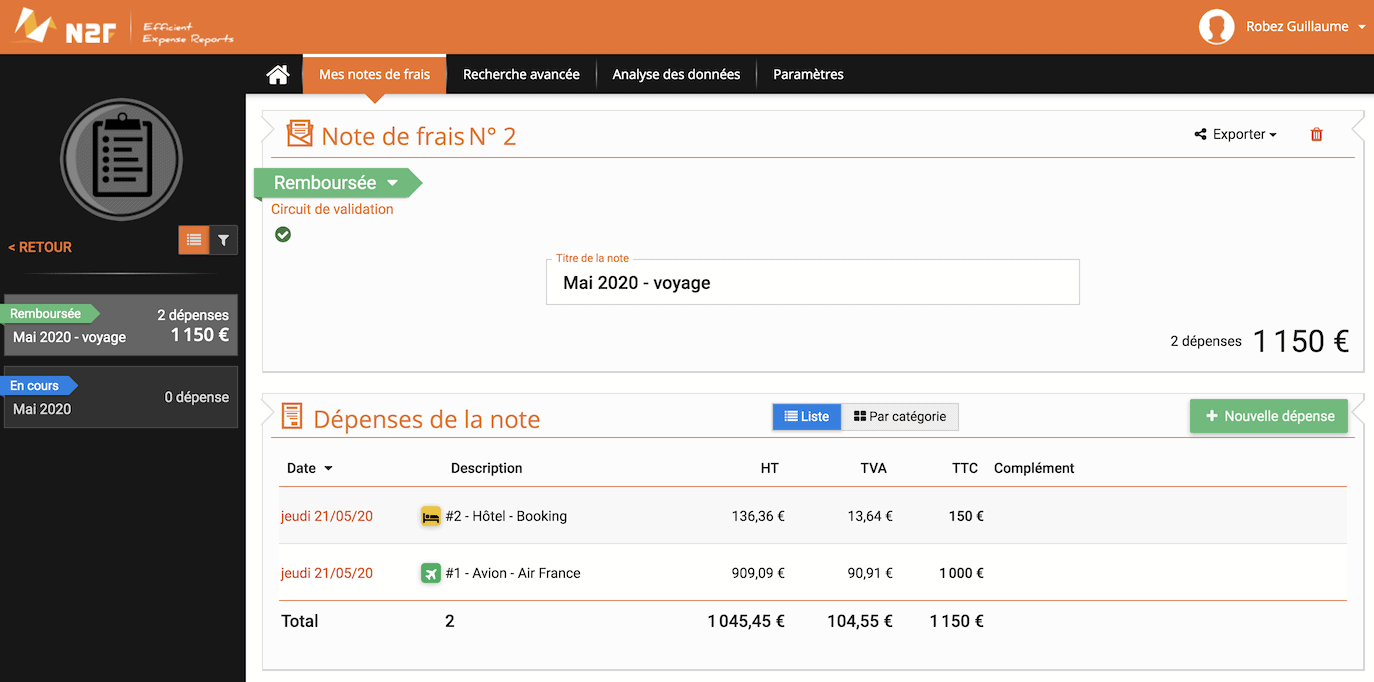

4. N2F

N2F est une application française conçue pour la gestion des notes de frais à l’international. Elle fonctionne donc avec un mode hors connexion et peut convertir automatiquement 170 devises selon un taux de change de référence. Paramétrée pour tout type de dépense, l’application dispose aussi d’un module Google Maps pour visualiser la distance parcourue et calculer les frais kilométriques. Enfin, si le collaborateur est pressé, il peut simplement consigner la dépense et remplir le formulaire ultérieurement. L’application le relance pour éviter les oublis.

Coût : à partir de 3 € par mois selon le type d’entreprise.

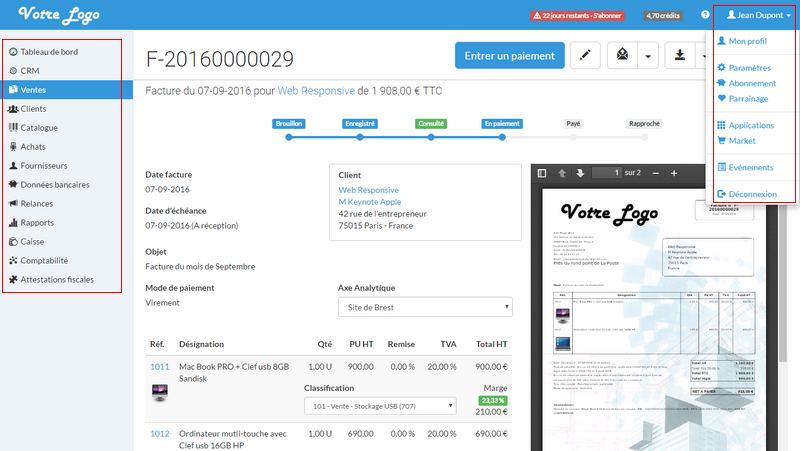

5. Evoliz

Evoliz est un logiciel complet de facturation. L’application associée permet de photographier les justificatifs des notes de frais, mais aussi toutes les autres factures. Les documents sont ensuite classés grâce à la technologie OCR (Reconnaissance Optique de Caractères). L’application Evoliz effectue également un traitement automatique des données, simplifiant ainsi le transfert vers le logiciel comptable. L’application bénéficie aussi d’un mode hors connexion, ce qui la rend utilisable en à tout moment.

Coût : essai gratuit pendant 30 jours, puis 24,90 € par mois sans option supplémentaire.

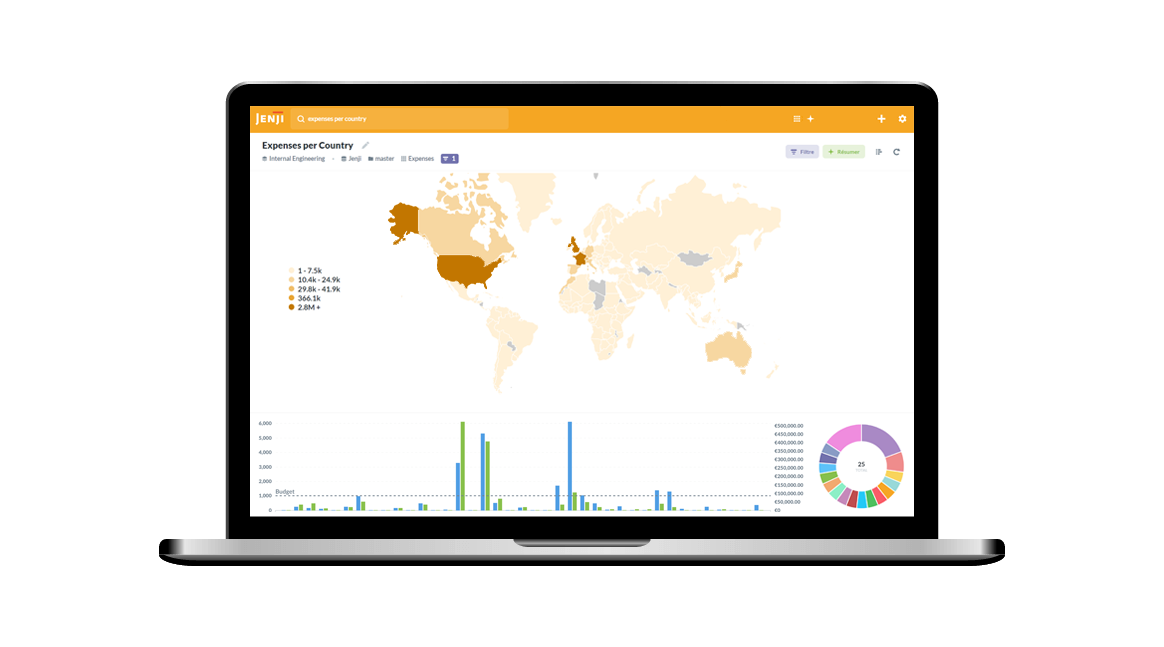

6. Jenji

Jenji est une plateforme française de gestion des notes de frais en temps réel. Très complète, cette application permet de gérer efficacement les dépenses des salariés. Elle s’appuie sur l’intelligence artificielle pour traiter les différents documents, mais aussi pour vous proposer des services tels que l’optimisation financière. Adaptée à tous les profils, l’application Jenji offre différentes versions, dont l’une est conçue pour les comptables. Elle leur permet notamment d’utiliser l’OCR pour faciliter le traitement des factures.

Coût: • Formule “Plan Solo” : gratuite. • Formule “Plan Team” : 5 € par mois et par utilisateur actif. • Formule “Plan Entreprise” : sur devis.

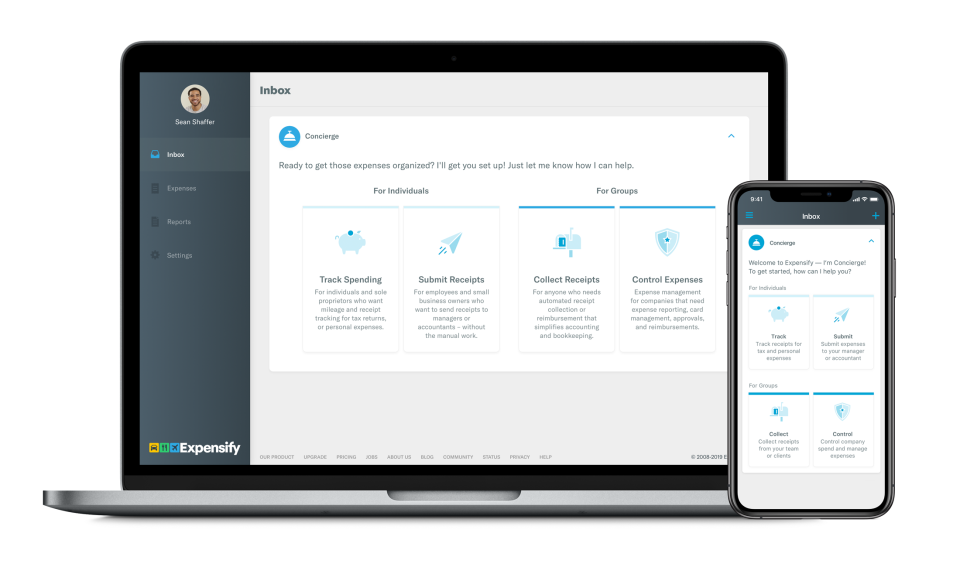

7. Expensify

Cette application venue d’outre-Atlantique ne se contente pas de gérer les justificatifs de dépense. Elle propose également d’autres fonctions telles que les notifications de vol, les retards à l'embarquement, ou encore le suivi par GPS qui doit être activé pour le calcul des frais kilométriques. Cette solution a été pensée pour s’adapter à toutes les activités, elle peut donc être personnalisée pour mettre en avant les postes de dépenses les plus récurrents de votre entreprise.

Coût : • Individuel : gratuit. • Team : 4,50 € par mois et par utilisateur. • Corporate : 8 €/utilisateur/mois.

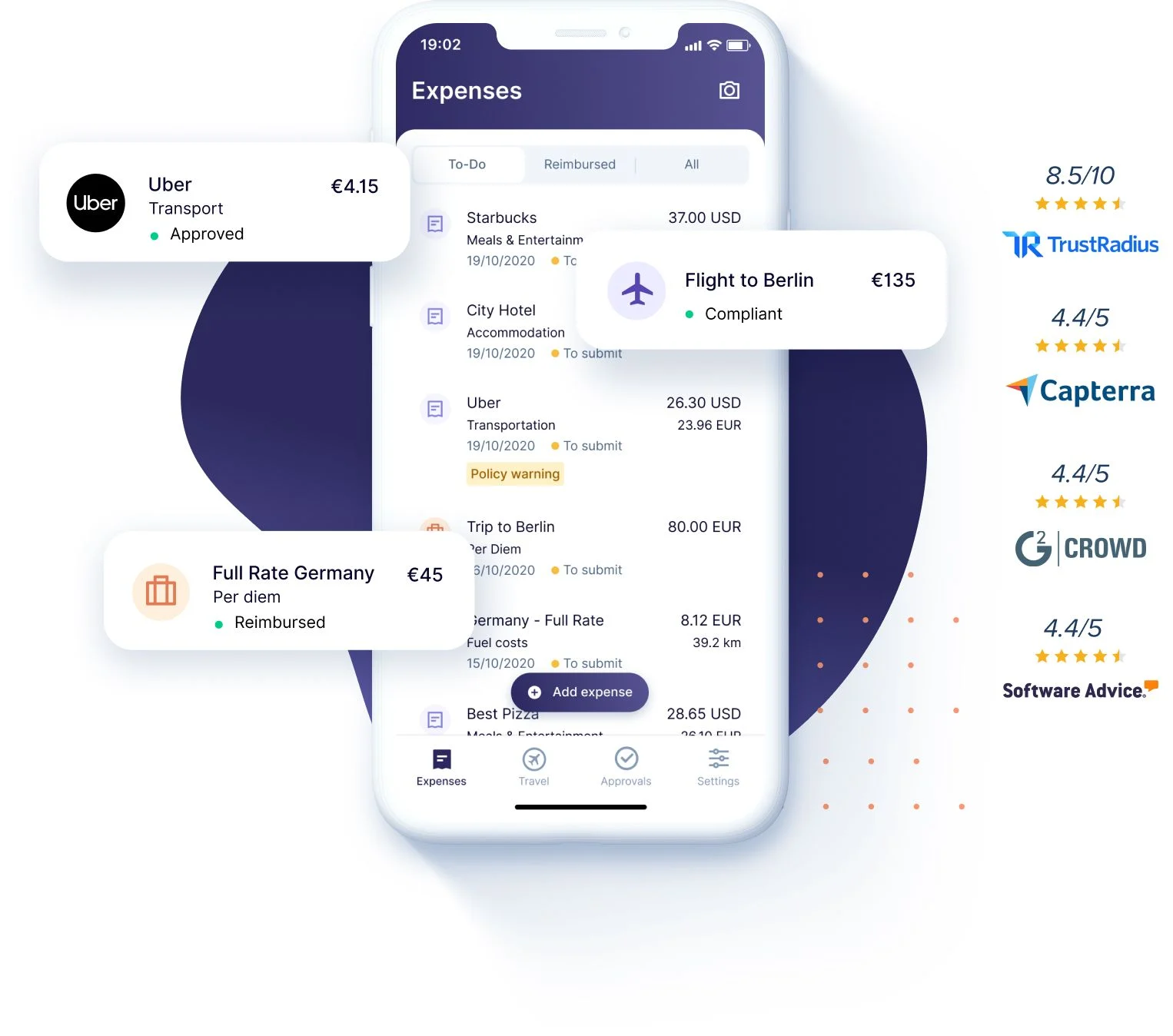

8. Rydoo

Rydoo, anciennement Xpenditure, est une application de gestion des notes de frais belge. Complète et simple à utiliser, elle est capable de repérer les doublons et vous avertit quand vous prenez 2 fois le même justificatif en photo. Rydoo offre la possibilité aux managers de valider une dépense en temps réel, ou de gérer les dépenses à grande échelle en paramétrant des filiales et succursales à l’étranger. Les données et rapports peuvent être directement exportés sous plusieurs formats et transférés vers les principaux logiciels comptables.

Coût : • Team : 6 € par utilisateur actif et par mois avec un abonnement annuel. • Growth : 8 €/utilisateur actif/mois avec un abonnement annuel. • Entreprises : sur devis.

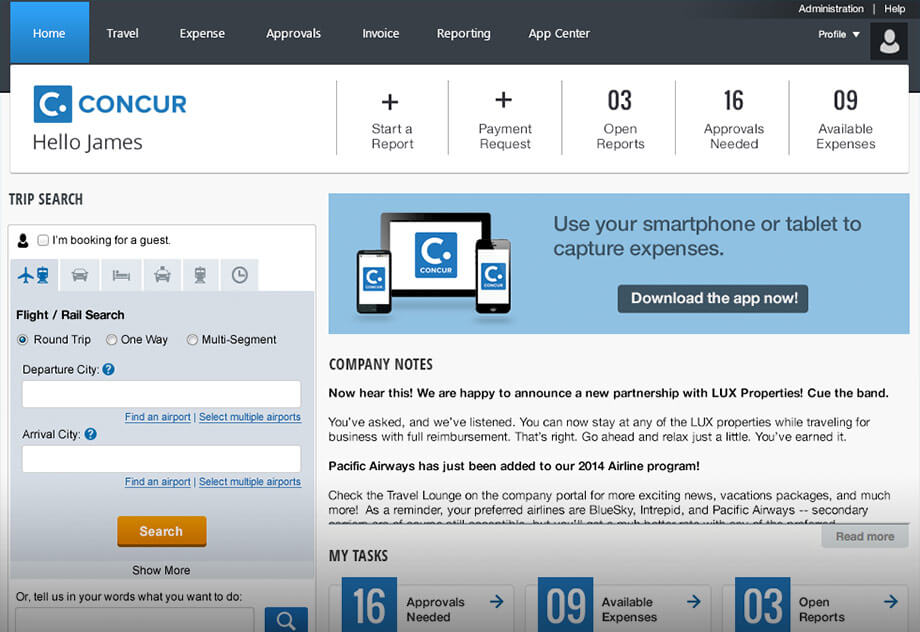

9. Concur

Concur est une application américaine, intégrée à SAP, solution complète utilisée principalement par les grands groupes et ETI de plus de 700 employés. Comme avec les autres applications, les employés peuvent photographier les justificatifs avec leur smartphone. Le manager peut ensuite valider rapidement la demande et déclencher le remboursement de la note de frais.

Coût : sur devis uniquement.

Toutes les solutions développées avec les applications mobiles de gestion des notes de frais ne se valent pas. Pour choisir l’offre la plus adaptée, il est donc essentiel de faire le point sur vos besoins et vos attentes. En optant pour un compte pro en ligne dans une néobanque par exemple, vous permettez à vos salariés de gagner aussi en tranquillité d’esprit puisqu’ils n’ont plus à avancer les frais avec leur argent personnel.

Besoin de faire le point ? Contactez dès maintenant notre équipe d'accompagnement.