À l’heure de la dématérialisation, les moyens de paiement n’échappent pas à la tendance. Outre la carte bancaire physique, il est dorénavant possible de régler ses achats avec une carte de paiement virtuelle. Version dématérialisée d’une carte bancaire traditionnelle, elle en présente presque les mêmes caractéristiques. Utiliser ce moyen de paiement virtuel peut s’avérer particulièrement efficace, notamment parce qu’il facilite la gestion des notes de frais.

Qu’est-ce que la carte virtuelle ?

La carte virtuelle Mastercard est la solution nouvelle génération de la carte bancaire. Comme une Mastercard classique, elle permet de régler n’importe quelle dépense sur Internet ou à distance : achats sur internet, frais de transport, réservations d’hôtels, ou encore factures de fournisseurs.

Ce type de carte bancaire ne possède, bien entendu, pas de forme matérielle. Il s’agit d’un numéro unique composé de 16 chiffres (comme sur une carte de paiement classique), d’une date de validité au format MM/AA et d’un cryptogramme à 3 chiffres. Ces informations sont communiquées à l’utilisateur par SMS, par email ou via une application dédiée.

Il existe 2 types de cartes virtuelles :

- la carte à usage unique, qui n’est valable que pour un seul paiement.

- la carte à usage récurrent, qui peut servir à payer des abonnements ou des transactions récurrentes. Rattachée à l’achat en question, elle ne peut être utilisée chez un autre vendeur.

Le principal atout de la carte bancaire virtuelle est donc le haut niveau de sécurité qu’elle garantit, qu’il s’agisse de la version à usage unique ou à usage récurrent. En effet, même si un pirate parvient à s’emparer de vos données bancaires lors d’une transaction, il ne pourra rien en faire par la suite.

Fonctionnement de la carte virtuelle Mastercard

Obtenir une carte de paiement virtuelle est d’une grande simplicité. Il suffit de se rendre sur l’application bancaire dédiée ou sur le site internet. La carte étant générée pour une certaine somme, il est nécessaire d’indiquer le montant de la transaction.

L’utilisateur se voit ensuite attribuer un numéro de carte unique qu’il pourra utiliser pour régler son achat.

Bien entendu, la carte virtuelle n’est utilisable que pour des paiements à distance ou en ligne. Pour les paiements sur place, la carte bancaire physique reste la meilleure solution.

Un atout pour le traitement des notes de frais

Les salariés n’ont plus à avancer les frais

Gérer les dépenses d’équipe sans cartes virtuelles nécessite une certaine logistique :

- lorsque la carte bancaire de l’entreprise est mise à disposition des salariés, il faut la fournir à chaque nouvelle dépense.

- dans les autres cas, les salariés doivent effectuer une avance avec leur argent personnel et établir des notes de frais pour se faire rembourser.

Dans le premier cas, cela implique de faire pleinement confiance aux salariés. Le fait de passer la carte de main en main induit également un risque de perte non négligeable.

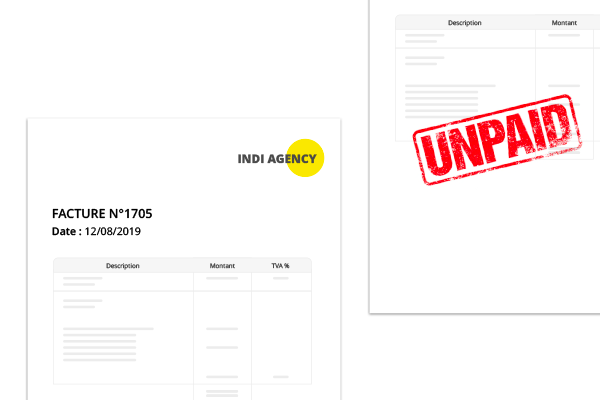

Puis, dans le cadre d’une avance faite par les salariés, il est nécessaire de mettre en place un processus de traitement des notes de frais. Ce poste de dépenses étant la première cause de redressement URSSAF, il est indispensable d’être vigilant et d’autant plus avec les justificatifs fournis. La meilleure solution consiste donc à se doter d’un logiciel spécifique. La gestion des notes de frais demande du temps, aussi bien aux salariés qu’au service financier ou comptable. D’autre part, lorsque les dépenses sont importantes, comme lors d’un déplacement à l’étranger, il devient rapidement difficile de faire avancer l’argent par le salarié. Et dans cette situation, il faut alors mettre en place une avance sur frais professionnels.

Avec les cartes virtuelles Mastercard, chaque collaborateur ayant besoin de réaliser des dépenses pour le compte de l’entreprise peut obtenir un numéro de carte temporaire. Le montant de la carte est défini par un référent qui peut suivre les mouvements grâce à une application rattachée. Il n’y a donc plus besoin de mettre à disposition des salariés une carte bancaire physique. De plus, les paiements sont effectués directement depuis le compte de l’entreprise. Les salariés n’ont donc plus à avancer les frais et à s’occuper de la fastidieuse tâche des notes de frais.

Une gestion simple grâce à une application dédiée

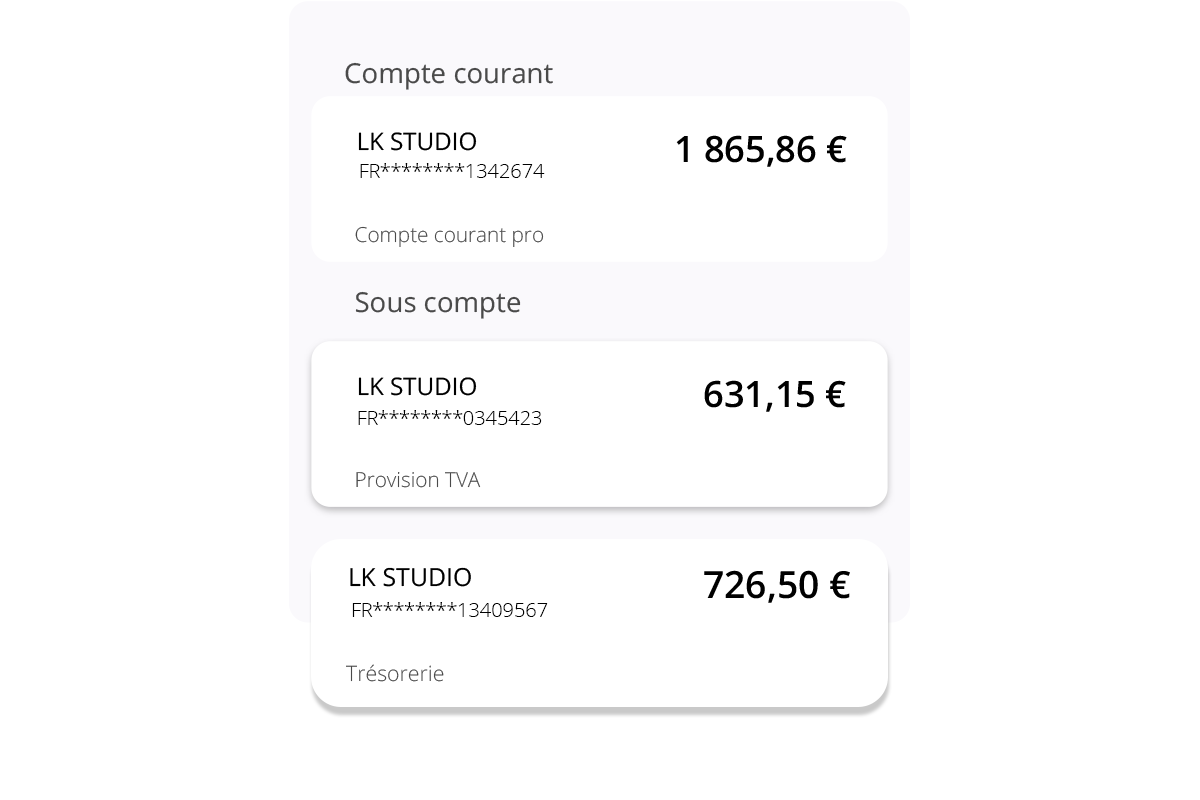

Dématérialisation oblige, tout se contrôle simplement du bout des doigts. En faisant appel à un compte pro comme Anytime, vous bénéficiez non seulement des cartes virtuelles Mastercard, mais aussi d’une application complète et facile à prendre en main.

Du côté du service financier, tout est suivi et contrôlé simplement. Les plafonds des cartes sont gérés en quelques clics et les cartes virtuelles générées en quelques minutes. Pour les collaborateurs, il devient extrêmement simple de rattacher une facture ou un reçu à un paiement. Une simple photo prise depuis un smartphone et le justificatif est joint directement à la ligne de dépense concernée. On oublie donc les tas de papiers et factures que le comptable doit vérifier et lier aux dépenses. Tout est déjà réalisé en amont par le salarié et validé par un manager.

Bien plus que de simples cartes de paiement, les cartes virtuelles Mastercard sont rattachées à un environnement complet, facilitant ainsi la gestion des dépenses d’équipe au quotidien. Entre gain de temps et sérénité, on oublie les longues procédures de gestion des notes de frais chronophages et génératrices de tensions. Avec son compte sans banque, Anytime met à votre disposition une gamme de services complète pour faciliter au quotidien la gestion des finances de votre entreprise.