Cet article fait suite à un premier volet qui vous explique en détail ce qu'est la TVA et les opérations qu'elle concerne. Vous êtes déjà perdu ? Rendez-vous ici 👈 pour reprendre les bases !

En (très) bref ✅ : La Taxe sur la Valeur Ajoutée est un impôt indirect payé par les consommateurs, récupéré par les entreprises, puis reversé à l’État.

Les différents taux 📊

Lorsque vous achetez un produit ou un service, le prix de la TVA est déjà inclus dans le prix que vous payez, on parle alors de prix TTC (Toutes Taxes Comprises).

Sans TVA, c'est un prix HT (Hors Taxes).

Le taux de la TVA varie selon le produit ou service que vous achetez ou vendez :

| Taux normal | Taux intermédiaire | Taux réduit | Taux particulier |

|---|---|---|---|

| 20% | 10% | 5,5% | 2,1% (en métropole) |

| Il concerne la majorité des produits et services et s'applique dès lors qu'aucun autre taux n'est prévu. | Il concerne notamment les produits agricoles non transformés, le bois de chauffage, les travaux d'amélioration d'un logement qui ne bénéficient pas du taux de 5,5%, certaines prestations de logement, les foires et salons, les jeux et manèges, les lieux culturels (musées, monuments), le zoo, les transports en commun, le traitement des déchets, la restauration. | Il concerne l'essentiel des produits alimentaires, les produits de protection hygiénique féminine, les équipements et services pour les personnes en situation de handicap, les livres, le gaz et l'électricité, les énergies renouvelables, les repas dans les cantines scolaires, la billetterie de spectacle et de cinéma, les travaux d’amélioration de la qualité énergétique des logements, les logements sociaux ou d'urgence, l'accession à la propriété. | Il est réservé aux médicaments remboursables par la sécurité sociale, aux ventes d’animaux vivants de boucherie et de charcuterie à des non assujettis à la TVA, à la redevance TV, à certains spectacles et à certaines publications de presse. |

Pour connaître le détail des taux de TVA en vigueur en France, en Corse et dans les DOM rendez-vous ici.

L'entreprise, intermédiaire entre le client et l'État 🤝

L'entreprise qui collecte la TVA sur ses produits et services en la faisant payer au consommateur n'est en fait qu'une intermédiaire, car le montant final de cette TVA est au final reversé à l'État par l'entreprise.

L'entreprise doit être rigoureuse dans la gestion de sa comptabilité car la moindre erreur concernant la TVA peut avoir un grand impact financier, notamment sur le chiffre d'affaires.

Le calcul de la TVA 🧮

Pour calculer le montant de la TVA sur vos produits ou services, rien de plus simple !

Divisez le prix HT (Hors Taxes) par 100 et multipliez-le par le pourcentage de TVA applicable à vos produits ou services.

Par exemple :

Vous êtes restaurateur et souhaitez vendre de délicieuses pizzas 🍕, vous avez besoin de calculer le prix TTC que vous devez demander à vos clients pour une pizza 4 saisons 🍂 .

Dans ce cas, imaginons que vous souhaitez la vendre 8 euros HT, vous réalisez le calcul suivant pour définir le montant de TVA :

8 euros / 100 x 10% de TVA dans ce cas précis = 0,80 centimes

Pour obtenir le prix TTC, celui que vous ferez payer à vos clients, vous ajoutez simplement le montant obtenu au prix HT, soit dans le cas de notre pizza 4 saisons : 8,80 euros.

Anytime à votre aide 💯

La semaine prochaine, nous consacrons un article complet à la TVA récupérable, celle que vous avez payée mais que vous n'auriez pas dû en tant que professionnel. Intéressant non ? 😉

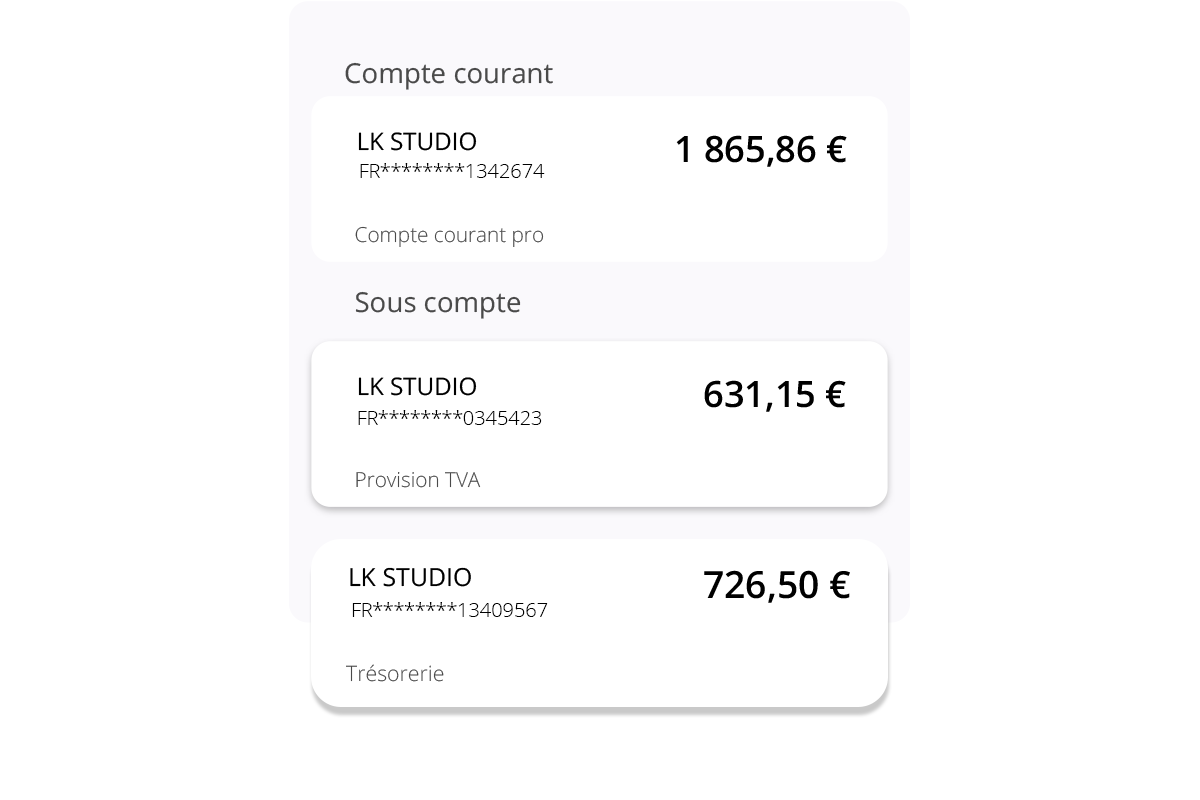

N'oubliez pas ! Anytime ce sont également des solutions clés en main pour faciliter la gestion de votre comptabilité, directement associées à votre compte bancaire !

Vous souhaitez en savoir plus ? Cliquez ici 👈