Payez, gérez et comptabilisez simplement vos notes de frais et les dépenses d'entreprise. Dépensez dans plus de 150 devises aux taux de change Mastercard. Oubliez les frais de change cachés !

1. Des cartes Mastercard plafonnées pour vos employés

Chaque collaborateur dispose d'une carte Mastercard plastique ou virtuelle ce qui permet d'automatiser les relevés des notes de frais de vos collaborateurs

Le partage de la carte bancaire société c'est terminé ! Fini la course aux justificatifs !

- Carte plastique pour des achats (Restaurants, magasins...)

- Carte virtuelle à usage unique pour des achats à distance (VAD) (réservation hôtel...)

- Carte virtuelle plafonnée pour gérer vos dépenses récurrentes (Abonnement, Fournitures, Office dépôt, Nespresso...)

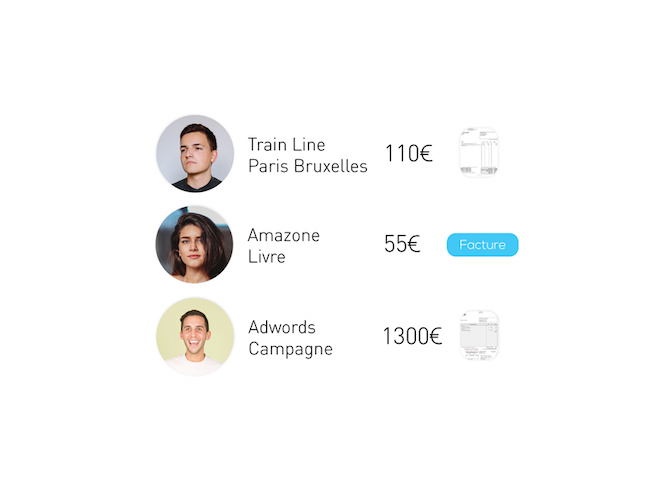

2. Accepter ou refuser

Accepter ou refuser les demandes des notes de frais de vos collaborateurs. Avant de pouvoir utiliser leur carte, vos collaborateurs doivent au préalable vous demander de fixer un budget maximum qui pourra être dépensé avec les cartes. Vous êtes assuré que votre collaborateur ne pourra pas dépenser plus que le montant que vous avez défini. + Identification du collaborateur + Montant de la dépense + Justification de la dépense + Si vous acceptez la demande du collaborateur, les fonds seront disponibles sur sa carte dans la limite fixée

3. Contrôler les dépenses

Contrôler les dépenses de la société, en temps réel. Vous maîtrisez tout ce qui a été dépensé. Filtrez les dépenses pour repérer les achats non justifiés. + Les dépenses sont remontées en temps réel. + Vous savez qui dépense quoi et quand.

+ Retrouver pour chaque transaction le justificatif des frais engagés.

+ Anytime saisit les montants de TVA pour faciliter votre comptabilité.

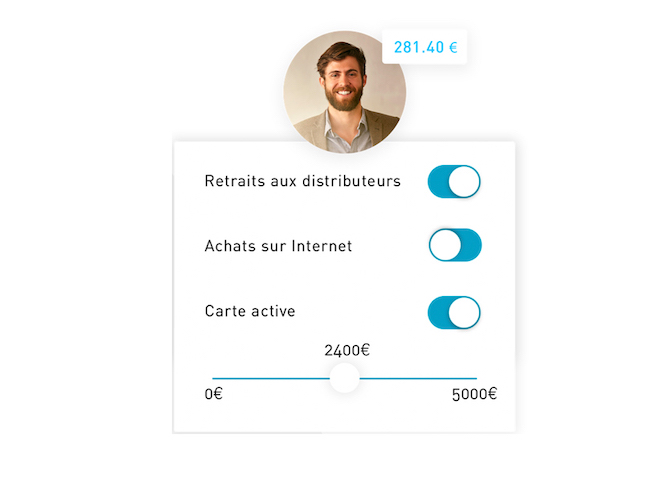

4. Plafonds et budgets alloués

Définir les plafonds ou budgets par collaborateur. + Vous définissez un plafond par carte qui ne pourra pas être dépassé.

+ Lorsque le plafond est atteint, la carte est bloquée.

+ A tout moment vous pouvez augmenter le plafond de la carte.

+ A tout moment vous pouvez bloquer ou annuler une carte.

5. Automatiser la comptabilité

Automatiser le traitement des frais de la société + Chaque paiement doit être justifié par une facture.

+ Les montants de TVA sont saisis par les équipes d’Anytime + Toutes les dépenses sont associées à des catégories de marchands.

+ Les dépenses peuvent être associées à votre plan comptable.

+ Intégration automatique dans vos logiciels comptables ou export en un clic.

6. Optimiser le contrôle sur vos dépenses

- Achat en ligne : Les employés utilisent une carte virtuelle plafonnée et à usage unique.

- Lors de déplacements :Les employés utilisent une carte plastique Anytime MasterCard plafonnée pour payer leurs frais professionnels.

-

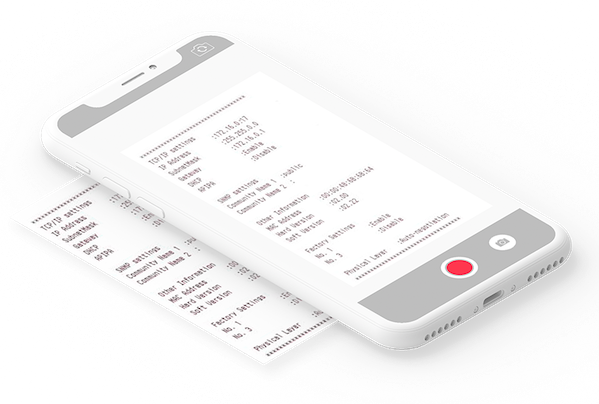

Notes de frais automatiques : Les transactions sont remontées en temps réel dans l’espace client. Les employés prennent en photo la facture ou la transfère par mail.

-

Reporting en temps réel : les transactions sont remontées en temps réel. Vous savez qui dépense quoi et quand.

- Valider/refuser : Vous recevez les demandes de paiements des employés. Vous savez qui veut dépenser quoi. Vous acceptez ou refusez les demandes par SMS ou depuis votre interface Anytime.

- Réconciliation intelligente : Toutes les transactions sont réconciliées par employé, par catégorie, montant TVA... plus besoin de compléter un tableur.

- Intégration comptable : Les transactions peuvent être intégrées en temps réel dans les logiciels comptables de nos partenaires où un export suffit pour rapatrier vos données.

- Archivage numérique : Les justificatifs des frais professionnels sont archivés sur un serveur sécurisé. Une recherche par mot clé, employé ou transaction vous permet de retrouver rapidement un justificatif.

Quels sont les avantages de la solution Anytime ?

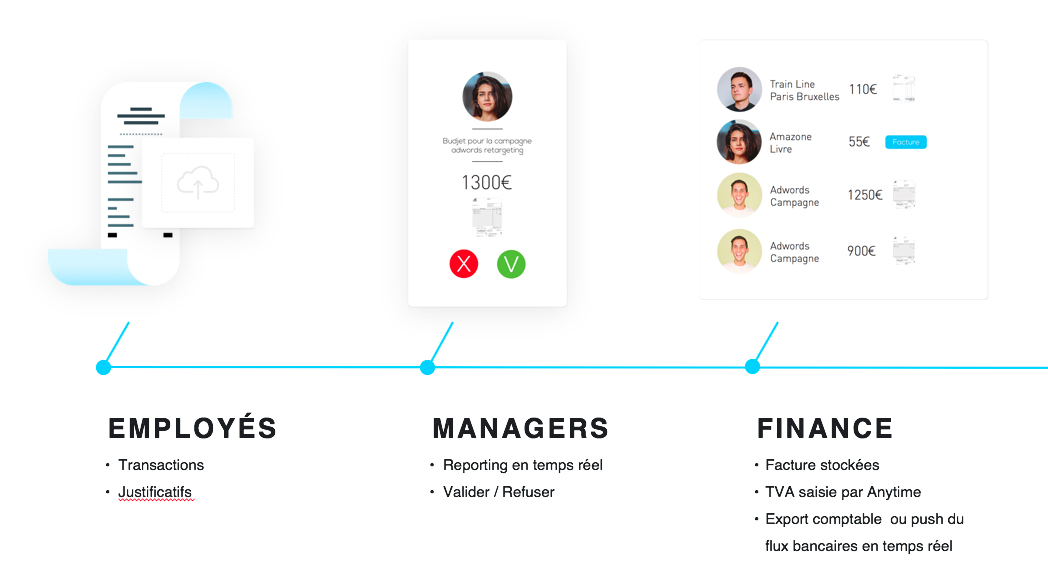

1. Avantages pour les employés

- Achat en ligne : Les employés utilisent une carte virtuelle Mastercard plafonnée et à usage unique.

- Lors de déplacement : Les employés utilisent une carte plastique Anytime Mastercard® plafonnée pour payer leurs frais professionnels

- Notes de frais automatiques : Les transactions sont remontées en temps réel dans l’espace client Anytime. Les employés prennent en photo la facture ou la transfère par email

2. Avantages pour les managers

- Reporting en temps réel : Toutes les transactions sont remontées en temps réel. Vous savez qui dépense quoi et quand

- Valider/refuser : Vous recevez les demandes de paiements des employés. Vous savez qui veut dépenser quoi. Vous acceptez ou refusez les demandes par SMS ou depuis votre dashboard Anytime

3. Avantages pour les comptables et le service financier

- Réconciliation intelligente : Toutes les transactions sont réconciliées : par employé, par catégorie, montant TVA…Plus besoin de compléter un tableur

- Intégration comptable : Les transactions peuvent être intégrées en temps réel dans les logiciels comptables de nos partenaires où un export suffit pour rapatrier vos données

- Archivage numérique : Les justificatifs des frais professionnels sont archivés sur un serveur sécurisé. Une recherche par mot clé, employé ou transaction vous permet de retrouver rapidement un justificatif

4. Fini le tableur Excel

Généralement dans 80% des sociétés le process est toujours le même : + Le collaborateur paie avec sa carte personnelle + Le collaborateur consolide dans un logiciel ou un tableur Excel ses notes de frais. + Il apporte à la comptabilité les justificatifs papiers + Le collaborateur perd 2h dans le mois + Le collaborateur est remboursé.

Ce mode de fonctionnemet est "Old school" !

Pourquoi imposer à un collaborateur de tout ressaisir alors qu'il a déja payé avec sa carte de crédit ? Tout est déja digitalisé. Avec Anytime c'est plus simple : + Chaque calloborateur a une carte Anytime + Aprés chaque transaction, le collaborateur reçoit un email qui l'invite à y répondre en ajoutant la facture justificative de la dépense. + Le collaborateur prend en photo la facture avec son téléphone. + A la fin du mois, si le collaborateur n'a pas saisi tous les justificatifs, Anytime le relance automatiquement par email.

5. Combien coûte la solution Anytime ?

Les frais Anytime sont indexés en fonction du nombre de cartes que vous comptez utiliser. Consultez la page tarif pour obtenir le détail des prix

Si vous comparez notre tarif avec des solutions concurrentes. Pensez à vérifier + Y-a-t-il des frais lorsqu'on dépose de l'argent sur les cartes ? Chez Anytime il n'y en a pas. + Y-a-t-il des frais lorsqu'on dépense de l'argent en Europe comme à l'international ? Chez Anytime il n'y en a pas. Les frais de change sont de 0% alors que chez nos concurrents ils sont de 1,5% à 3,5%

Pour en savoir plus sur les notes de frais

- Les 8 règles pour optimiser ses notes de frais. Lire

- Les solutions pour la gestion de vos notes de frais en ligne Lire

- Comment gérer les notes de frais et les dépenses de vos collaborateurs ? Lire

- Top 10 des solutions de gestion des notes de frais Lire

- Une gestion simplifiée des notes de frais avec les cartes virtuelles Mastercard Lire

- Quelles règles fixer pour rembourser les notes de frais dans votre entreprise ? Lire