Vous avez décidé de lancer votre e-commerce ? Vous avez donc besoin de proposer différents modes de paiement à vos futurs clients.

Tarifs

- CB : 0,25€ + 1,2% par transaction

- Mastercard : 0,25€ + 1,8% par transaction

- Visa : 0,25€ + 1,8% par transaction

- PayPal : 0,10€ + Paypal

Si vous souhaitez négocier vos tarifs, une tarification par volume sur devis est disponible, réservée aux entreprises qui traitent plus de 1.000 transactions ou des transactions supérieures à 20.000 € par mois

Avantages

- Pas de frais minimum, sans frais cachés, sans engagement

- Inscription en 10 minutes

- Accès à toutes les fonctionnalités sans frais supplémentaires

- Plus de 25 moyens de paiement par le biais d’un seul contrat

- Possibilités de mise en place de paiements récurrents

- Une gestion simple des remboursements

- Parfait pour se développer à l’international (+100 devises)

- Paiements en ligne sécurisés

Même si le terme prestataire de services de paiement (PSP) ne vous est pas familier, vous passez probablement par ces derniers sans le savoir quand vous réalisez des achats en ligne. A l’ère de l’e-commerce, les PSP sont les entreprises qui vous permettent de payer les commerçants par carte bancaire sur internet. Ils ont un rôle d’intermédiaire entre les plateformes d’e-commerce et leurs clients. PayPal est par exemple un PSP. Quels sont les caractéristiques d’un PSP, et les avantages à les intégrer sur votre site de vente en ligne ?

Comment les PSP vous proposent de multiples solutions de paiement en ligne pour votre e-commerce

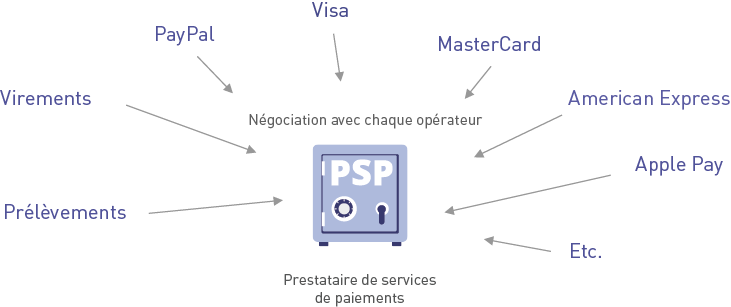

Un prestataire de services de paiement va vous aider à proposer à vos clients un large éventail de solutions de paiement. Plus vous proposez de solutions de paiements, plus les utilisateurs finaliseront leur achat sur votre site web. Dès que vous réglez un achat en ligne, ce dernier est géré par un prestataire de services de paiement – ou PSP. On distingue deux grands types de paiements :

Les paiements par carte bancaire

Le PSP va être l’intermédiaire entre la banque du client et du marchand. Il s’assure de faire le lien entre la banque émettrice, celle de l’acheteur, et la banque réceptrice, celle du vendeur.

Les autres moyens de paiement proposés

Il existe aujourd’hui des moyens de paiement propres à certains marchés. Il est donc nécessaire d’adopter une approche locale et proposer les moyens de paiement les plus adaptés selon les zones dans lesquelles vous vendez. Le vendeur peut donc, via un seul contrat, utiliser tous ces modes de paiement différents : c’est une offre dite « full service »

Mollie : le meilleur PSP pour intégrer les paiements en ligne sur un site web

Mollie est une des références en matière de prestation de services de paiement, opérant dans l’industrie depuis 2004.

L’ADN de Mollie est de faciliter les opérations de paiement en ligne. Tout comme Anytime, Mollie a voulu offrir un outil moins onéreux que les banques traditionnelles, tout en étant plus simple et intuitif. Cette plateforme est accessible à tous les professionnels de la vente en ligne.

L’un des objectifs principaux de Mollie est d’offrir au consommateur une expérience unique d’achat pour aider les entrepreneurs : en rendant l’expérience client intuitive, on augmente ainsi le taux de transformation.

Deux grands types de fonctionnalités sont proposées par Mollie.

Les paiements directs

Avec les différents plugins proposés par Mollie, intégrez facilement à votre site internet un éventail de méthodes de paiement pour encaisser vos clients. Ils peuvent ainsi régler par carte bancaire facilement et sans effort.

Pour couvrir tous les besoins de votre clientèle, Mollie prend également en charge de nombreux moyens de paiements très utilisés comme PayPal, les virements et prélèvements SEPA, mais également des solutions extrêmement populaires dans certains pays (Bancontact en Belgique, iDEAL aux Pays-Bas, ou encore Giropay en Allemagne pour ne citer qu’eux.)

Les paiements récurrents

Grâce à Mollie, vous pouvez récolter des paiements récurrents sans effort. Cette solution est parfaite si vous proposez des abonnements à vos clients. Vous pouvez personnaliser la collecte des paiements selon vos besoins (hebdomadaires, mensuels, annuels…) et choisir les montants prélevés.

Après le premier paiement, vous êtes prêt à collecter des paiements de façon récurrente : les coordonnées bancaires ne sont communiquées par le client qu’une seule fois.

Pourquoi Anytime fait confiance à Mollie pour votre e-commerce

Anytime a pour vocation de simplifier la vie des entrepreneurs en leur offrant une palette de services pour améliorer leur quotidien. En s’associant avec Mollie, nous vous proposons de bénéficier d’une solution complète qui améliorera votre satisfaction client et votre taux de transformation.

1. Des paiements immédiats

Vous recevez en quelques minutes les paiements de vos clients, et les gérez sur une même interface.

2. Boostez votre croissance à l’international

Élargissez vos horizons ! Vous avez l’occasion grâce à Mollie de vous développer à l’international. Recevez des paiements dans toutes sortes de devises. Vous pouvez ainsi choisir de viser différentes régions du monde selon votre stratégie commerciale. Mollie vous propose les moyens de paiement les plus utilisés dans différents pays.

Par exemple, si vous souhaitez vous développer aux Pays-Bas, la terre mère de Mollie, vous devez prendre en compte que la solution de paiement privilégiée là-bas est iDeal. Les allemands préfèreront le virement bancaire grâce à la solution Sofort. Les habitudes varient d’un pays à l’autre, et Mollie vous permet de vous adapter à chaque situation en proposant le moyen de paiement adéquat.

3. Gagnez du temps avec l’administratif : un seul contrat pour une multitude de solutions de paiement !

Avec un seul contrat, Mollie met à votre disposition une multitude de moyens de paiement. Nul besoin de contacter chaque opérateur de paiement séparément, Mollie vous fait gagner un temps précieux en vous proposant d’intégrer différentes solutions de paiement sur une même plateforme de paiement.

4. Une intégration facile et une customisation de votre page de paiement

Comment faire en sorte que l’utilisateur aille au bout de l’achat ? Pour baisser le taux d’abandon de panier au moment de payer, proposer une page de paiement optimisée est primordial. Vous augmentez ainsi vos revenus. Mollie vous permet de mettre votre client en confiance pour conforter son achat en concevant une page de paiement en suivant votre identité visuelle, à votre image.

5. Satisfaire son client avec le choix des différentes méthodes de paiement

Pour éviter de perdre des clients et ainsi augmenter votre taux de transformation, Mollie vous propose les moyens de paiement les plus utilisés. Ainsi, vous couvrez les moyens de paiement populaires pour que le client aille au bout de l’achat.

6. Mollie, garant de votre sécurité

En tant que fournisseur de services de paiement, Mollie répond à des exigences de sécurité strictes et s’engage à faire parvenir les paiements en ligne effectuées par les acheteurs en toute sécurité au marchand.

7. Tarifs avantageux

Pas de droit d’entrée, pas d’abonnement, vous accédez directement à toutes les fonctionnalités proposées par Mollie. Vous ne payez que pour les transactions réussies.

Il faudra donc payer un montant fixe et/ou un pourcentage variable par transaction.

Pour les paiements par carte bancaire, les frais s’élèvent à 0,25€ par transaction plus une commission qui varie selon le type de cartes.

Pour les prélèvements et les virements SEPA, des frais fixes de 0,25€ s’appliquent par transaction.

Enfin, les autres moyens de paiements sont également facturés par le biais de frais de transaction, modulables en fonction de la solution de paiement utilisée ainsi que du pays où est émis l’achat.

Comment installer Mollie sur son site ?

Comment lier Mollie à votre plateforme de paiement dépend du système que vous utilisez.

Dans tous les cas, vous aurez besoin d'une clef API. Vous pouvez trouver cette clef sur le site de Mollie dans votre compte dès que votre site web aura été approuvé.

Bénéficiez dès aujourd’hui de l’expertise de Mollie x Anytime

Comment découvrir l’offre de notre partenaire Mollie ? C’est très simple, il vous suffit de vous inscrire sur le site de la plateforme de paiement pour découvrir gratuitement la solution.