À la création de votre entreprise, il est important de bien choisir votre prestataire de services bancaires. En effet, une banque mal choisie sera source de soucis dont vous n’avez pas besoin. Parmi les banques traditionnelles, la HSBC propose une offre qui regroupe les comptes professionnels et personnels. De son côté, Anytime a développé une offre 100 % en ligne, simple, claire et personnalisable qui vous permet d'évoluer du compte pro indépendant au compte professionnel pour les entreprises

Le compte pro du HSBC, services et tarification

L’offre pro de la HSBC porte le nom de HSBC Fusion. Un nom qui souligne le fait que cette offre regroupe la gestion personnelle et professionnelle. L’offre pro HSBC est destinée à tous les statuts d’indépendants et TNS dont le chiffre d’affaires ne dépasse pas 1,5 million d’euros.

Que comprend l’offre compte pro HSBC ?

L’offre pro de la HSBC est constituée de 3 conventions de compte. L’offre basique « HSBC Fusion Start » est un socle de compte pro sur lequel s’ajoutent des services complémentaires dans les deux autres packs. Ce socle comprend :

+ La tenue du compte pro

- Une carte Visa Business

- Un service de banque à distance

- Une exonération des frais sur les principales opérations quotidiennes dont : Relevé de compte mensuel ou e-relevé, virement SEPA reçu, commission de change, opposition sur carte bancaire, virement émis en ligne ou par l’application, chéquier

L’offre HSBC Fusion Fast complète les services de l’offre Fusion Start avec les commissions de mouvement et d’actualisation à 0 €

L’offre supérieure HSBC Fusion Smart permet d’obtenir une carte Visa Gold Business à la place de la Visa Business classique ainsi que tous les avantages qui s’y rapportent.

Comparer les tarifs d’un compte pro HSBC avec le compte pro Anytime.

Le tarif global de votre compte pro HSBC dépend des services que vous décidez d’y inclure ainsi que de votre chiffre d’affaires. Les 3 offres pros de la HSBC sont payables mensuellement.

| Offre | Fusion Start | Fusion Fast | Fusion Smart |

| Tarif du compte pro mensuel | 17,00 € HT/mois (Soit 204€/an) | 25,00 € HT/mois (Soit 300€/an) | 30,00 € HT/mois (Soit 360€/an) |

Dans le cas où vous ne trouvez pas les services dont vous avez besoin parmi les 3 offres proposées, il est également possible de composer votre formule à partir des produits à la carte.

|

|

||

|---|---|---|---|

| Anytime | HSBC | ||

| Formes juridiques acceptées | SA, SAS, SASU, SARL, EURL, EI(RL), SCI, Professions libérales, Associations et Auto-entrepreneur en personne physique et morale. Plus d'infos ici. | indépendants ou profession libérale uniquement | |

| Ouverture de compte pro en ligne | Oui | Non | |

| Forfait mensuel | A partir de 9,50€ TTC | A partir de 30€ TTC | |

| Commission de mouvement | Aucune commission de mouvement | Aucune commission de mouvement | |

| Alerte solde temps réel | 0€ | 0,34€/SMS | |

| Prix de la carte bancaire | 0€/an 1 carte dans l’offre | 0€/an 1 carte dans l’offre | |

| Paiement hors zone euro | 0€ pas de frais appliqués | 2,90% sur les transactions | |

| Retrait hors zone euro | 2€ | 3,05€ + 2,90% sur le montant retiré | |

| Prix de la carte bancaire virtuelle | 50 inclus dans l’offre | Non | |

| Module gestion de notes de frais | inclus dans l’offre à partir du forfait Easy | Non | |

| Gestion dynamique des plafonds de cartes | inclus dans l’offre | Non | |

| Terminal de paiement | Offert par notre partenaire | Sur devis après une étude personnalisée | |

| Solution e-commerce | 0€/mois et 0,25 € + 3,8% par transaction | 23,90€/mois et commission à la transaction à négocier. Contrat VAD nécessaire | |

| Type de carte bancaire | Mastercard | Visa | |

| Forfait banque à distance | 0€/an | de 12,6€ TTC/mois | |

| Chéquier | Non | Gratuit | |

| Encaissement de chèques | Non | Illimité | |

| Crédit ou autorisation de découvert | Sous condition avec nos partenaires | Oui | |

| Service client | Service client par mail et chat inclus. Conseiller disponible par téléphone dès le forfait Easy. | Conseiller attitré sur RDV |

Pour connaître les tarifs des services à la carte, vous pouvez consulter les plaquettes tarifaires du HSBC. La souscription à une offre groupée de services vous permet de bénéficier de tarifs préférentiels sur les tous les services que vous ajouterez à la convention

Comment ouvrir un compte pro au HSBC ?

L’ouverture d’un compte HSBC n’est possible que sur rendez-vous avec un conseiller. L'ouverture d'un compte professionnel en ligne n'est pas possible. Si vous êtes déjà client, vous pouvez programmer un rendez-vous avec votre conseiller depuis votre espace personnel sécurisé. Dans le cas contraire, vous pouvez prendre contact via le site internet ou par téléphone.

Lors de votre rendez-vous pour l’ouverture de compte pro, munissez-vous au minimum des justificatifs suivants :

- Un justificatif de votre activité

- Un ou deux justificatifs d’identité

- Un ou plusieurs justificatifs d’adresse du siège social

Pensez également à prendre avec vous tous les documents concernant votre entreprise et votre activité (bilans, comptes prévisionnels, statuts, extrait d’immatriculation…). Avoir tous les documents en main pourra vous éviter de perdre du temps en multipliant les rendez-vous.

Services et tarifs du compte pro Anytime

Destinée à tous les professionnels quels qu’ils soient, l’offre pro Anytime est un pack tout-en-un comprenant différents services. Assortie à de nombreuses options, l’offre de la néobanque pro se rend totalement personnalisable.

Ce qui est inclus dans l’offre pro Anytime

L'offre Start du compte pro Anytime comprend :

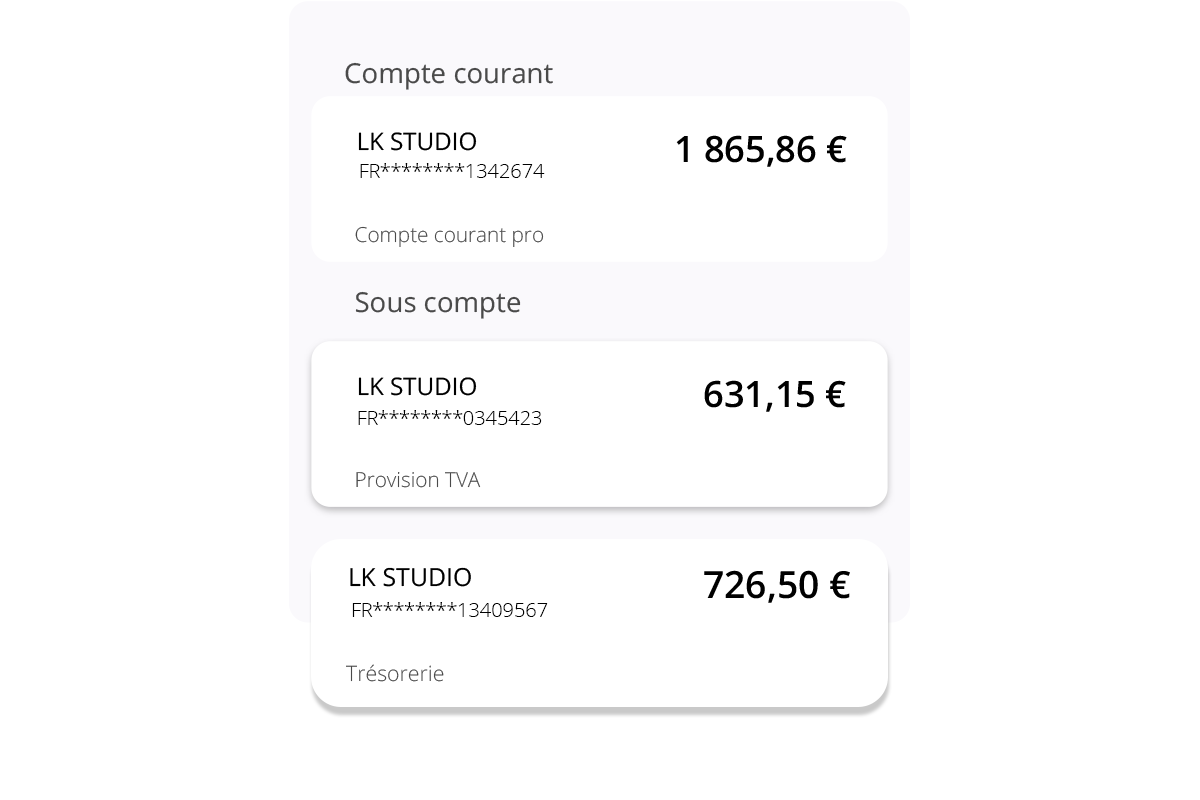

- Le compte courant professionnel

- Un compte courant personnel pour mieux jongler entre vos dépenses professionnelles et personnelles

- 1 carte Mastercard

- 50 Mastercard virtuelles pour payer sur internet ou à distance

- Une application de gestion complète permettant de réaliser toutes les opérations courantes sur internet ou depuis votre téléphone (virement en Europe comme à l’internationale, listing des transactions, blocage de sa carte, obtention du code PIN de sa carte 24h/24h…)

- La gratuité des virements et prélèvements en euros

- Soldes et alertes en temps réel

- Bouquet de services qui vous permet de bénéficier de nombreux services offerts par Anytime ou ses partenaires (gestion des notes de frais, terminal de paiement, gestion de la trésorerie,…)

D’autre part, ce compte pro en ligne donne la possibilité de mettre en place en toute simplicité des moyens d’encaissement tels que le lien de paiement par email ou SMS, le bouton de paiement pour site internet ou encore la commande d’un terminal de paiement pour encaisser des clients (fourni par Smile&Pay)

Comment ouvrir un compte pro Anytime ?

L’ouverture d’un compte pro Anytime se fait entièrement en ligne, à n’importe quel moment. En seulement 5 à 10 minutes, après avoir renseigné les informations essentielles et fourni une photo de votre pièce d’identité, vous pourrez accéder à votre compte et obtenir un RIB. Sous 48h00 votre compte sera activé (sous réserve d’avoir fourni la totalité des pièces demandées et listées ci-dessous)

Pour répondre aux obligations légales, l’ouverture d’un compte pro avec un RIB FR (permet de réaliser des prélèvements et des virements bancaire) est soumise à la nécessité de fournir :

- Une copie de pièce d’identité en cours de validité

- Un justificatif de domicile de moins de 3 mois à votre nom

- Un premier virement vers votre compte Anytime doit être effectué à partir d’un compte bancaire européen ouvert à votre nom.

Pour l’envoi de ces documents, une photo prise avec le smartphone est suffisante, ce qui permet de gagner un temps précieux lors de la souscription.

Avec des tarifs bien plus attractifs et une offre totalement adaptée aux professionnels, Anytime est une excellente alternative. Facile à prendre en main, l’application dédiée permet de réaliser toutes vos opérations du bout des doigts, en seulement quelques minutes. Une façon extrêmement simple de gérer les comptes de votre entreprise depuis n’importe où et à n’importe quel moment.