Dans notre métier, la confiance est essentielle

Notre métier nous impose d'être un coffre-fort de confiance. Vous nous confiez le fruit de votre travail, il est normal de le protéger avec la plus haute exigence.

10 points importants pour gagner votre confiance

Plus de 100.000 utilisateurs

Aujourd'hui, plus de 100.000 utilisateurs nous font confiance. Nos clients sont variés : ce sont aussi bien des auto-entrepreneurs que des associations ou des ETI. Maintenir un haut niveau de qualité pour chacun est notre priorité, et nous mesurons régulièrement le taux de satisfaction de nos clients pour nous en assurer.

Noté "excellent" par nos utilisateurs

Avoir des clients n'est pas le plus compliqué. Les rendre heureux et les fidéliser reste un défi quotidien. Régulièrement, nos clients sont interrogés sur la qualité de notre service et nous notent.

- Classé Bon à Excellent sur Trustpilot (4,6/5)

- Classé Excellent sur Apple (4,7/5)

- Classé Excellent par notre système de notation (15000 avis)

4,5/5

sur Trustpilot

4,6/5

sur App Store

4,6/5

sur NPS Anytime

Vos fonds sont protégés

L’argent déposé sur les comptes Anytime est isolé des fonds (trésorerie) de l'entreprise. Si Anytime est amené à faire faillite, vos fonds vous seraient intégralement restitués car ils sont cantonnés dans les livres du Crédit Mutuel Arkéa ou de la Société Générale. Le fait de cantonner des fonds signifie que personne d’autre que vous n’a accès à votre argent. Ni Anytime ni qui que ce soit d’autre.

Protection de votre identité

En France plus de 200.000 personnes seraient victimes d'usurpation d'identité. Pour garantir votre sécurité et protéger votre identité nous réalisons une identification vidéo qui permet de vérifier la pièce d'identité et la correspondance entre la photo de la pièce d'identité et la personne qui présente la pièce d'identité.

Sécurisation des achats 3Ds

Anytime utilise la technologie 3D Secure pour la sécurisation de vos paiements en ligne. Lorsque cela est nécessaire, vous devrez valider vos transactions soit en vous connectant à l'application Anytime soit en saisissant le code reçu par SMS.

Authentification forte

Ce dispositif permet de renforcer la sécurité des paiements en ligne. Il consiste à vérifier que vous êtes bien à l'origine du paiement et il remplit les 3 conditions ci-dessous :

- une information que vous êtes seul(e) à connaître : mot de passe ou une question secrète

- l'utilisation d'un appareil qui n'appartient qu'à vous : téléphone portable

- une caractéristique personnelle : reconnaissance faciale ou empreinte digitale

Assurance fraude

Anytime inclut dans toutes ses cartes une assurance protection des moyens de paiement qui vous protège en cas d'utilisation frauduleuse de la carte jusqu'à 3000€.

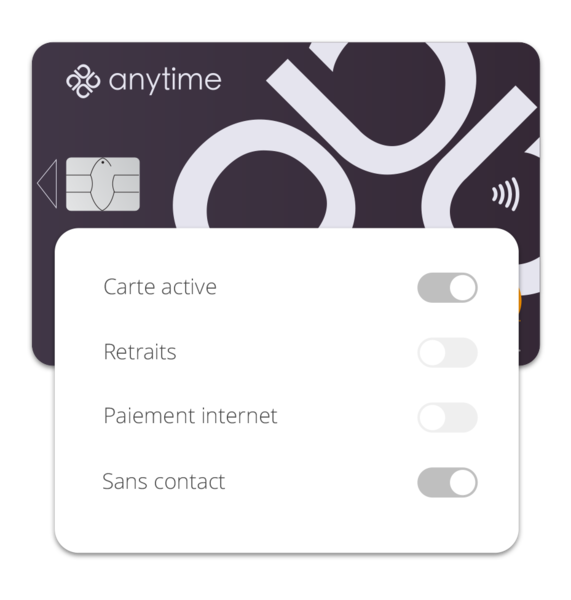

Verrouillage/Déverrouillage

Il suffit de vous connecter à votre espace client pour piloter vos cartes et votre compte :

- - Bloquer ou débloquer les paiements sans contact

- - Bloquer ou débloquer les paiements sur internet

- - Bloquer ou débloquer vos cartes

- - Autoriser ou refuser des accès à des collaborateurs

Protection de vos données

Anytime ne vend pas et ne vendra jamais vos données. Nous gagnons notre vie avec le montant des forfaits et les commissions versées par Mastercard, pas sur l'exploitation de vos données.