Start

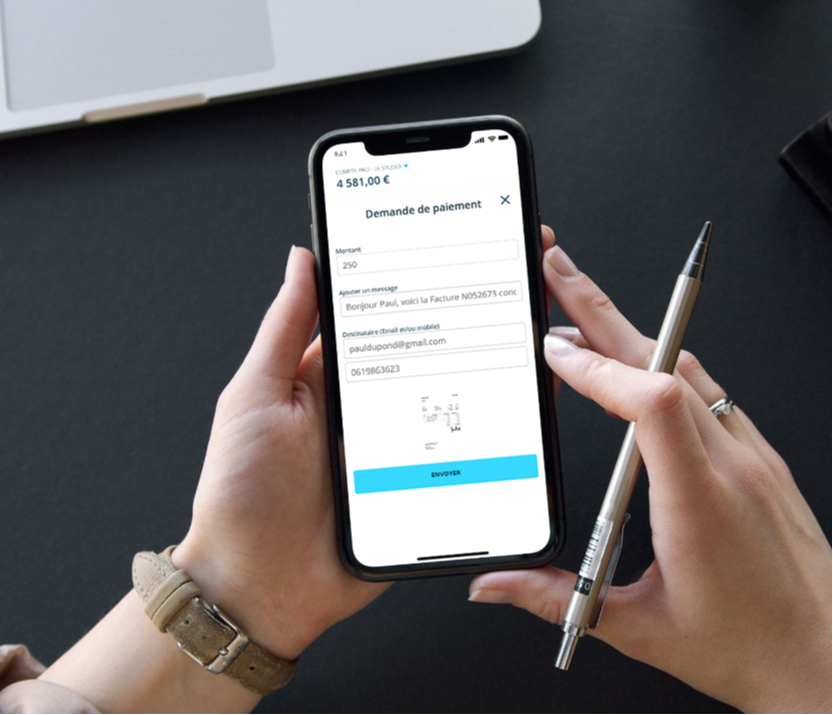

la gestion de mon activité

- Contact avec nos conseillers par Chat

-

1 carte Mastercard professionnelle ClassicPour en savoir plus sur les assurances, protections et plafonds inclus avec votre carte, rendez vous sur https://www.anyti.me/fr/cartes-mastercard-business

- 1 carte Mastercard personnelle

- 20 virements et prélèvements inclus par mois

-

1 terminal de paiement offert NEWTerminal de paiement Mini Smile OFFERT par notre partenaire Smile&Pay

- 1 accès pour vous ou votre comptable