En 2022, le taux de marge des entreprises, qui rapporte l’excédent brut d’exploitation à la valeur ajoutée de l’entreprise, est retombé à 31,4 %, se rapprochant des données enregistrées en 2018. Cet écart pourrait se creuser l’année prochaine en raison de la crise énergétique. Explications.

Une dégradation des marges d’environ 4 points

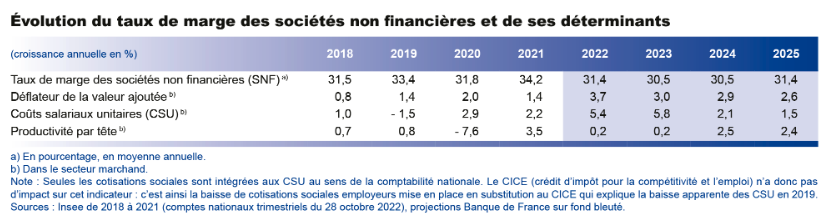

Les données publiées par l’Insee et la Banque de France montrent que le taux de marge des sociétés non financières a reculé en 2022, passant de 34,2 à 31,4 %, un niveau qui se rapproche de celui des années précédant la crise sanitaire. Selon l’économiste Daniel Cohen qui a publié une chronique récente dans l’ « Obs » à ce sujet, ce chiffre n’est pas alarmant, car 2021 a été une année exceptionnelle, la rentabilité des entreprises ayant été dopée par le plan d’aides déployé par le gouvernement.

L’écart constaté par rapport à 2021 s’explique aussi par la guerre en Ukraine qui a entraîné des difficultés sur les chaînes de valeur internationales et des pressions à la hausse sur les prix des matières premières non alimentaires. Les entreprises sont particulièrement impactées par les augmentations de leurs factures d’électricité et de gaz qui pèsent sur leurs coûts de production et leurs marges.

D’après les enquêtes de conjoncture de la Banque de France, près de 20 % des entreprises, notamment dans l’industrie, estiment que la situation énergétique aura un impact fort sur leurs marges au cours des trois prochains mois.

L’évolution globale du taux de marge en 2022 cache de fortes disparités entre les secteurs d’activité. Au cours du 1er trimestre, les secteurs énergétiques ont par exemple vu leur taux de marge progresser, ce qui n’est pas le cas des branches manufacturières. Désormais, la tendance penche vers un rééquilibrage sectoriel suite aux mesures mises en place à l’échelle nationale et européenne.

Un taux de marge en net recul en 2023

La situation risque de se compliquer en 2023 pour les entreprises du fait de l’arrivée progressive à échéance des contrats à tarifs fixes et de la poursuite de la hausse des coûts salariaux unitaires. La Banque de France anticipe une chute de 0,9 point du taux de marge en 2023 et 2024.

D’autres facteurs vont impacter ce ratio. Parmi eux, on peut citer le manque de dynamisme de l’activité économique.

« La moindre demande adressée, la plus forte appréciation du change et la remontée plus prononcée des taux d’intérêt, combinées aux révisions à la hausse de nos prévisions d’inflation nous conduisent à prévoir un ralentissement un peu plus marqué en 2023 », indique l’institution qui projette une croissance annuelle à 0,3 %.

Quant aux taux d’intérêt, ils devraient continuer de progresser dans le sillage des taux et de l’inflation.