En 2023, de nouvelles aides publiques destinées à alléger et régler les factures d'énergie (gaz et électricité) des entreprises viennent compléter les dispositifs mis en place en 2022.

Les aides publiques 2022 prolongées en 2023

Pour régler leurs factures d'énergie 2022, les TPE ont eu droit au bouclier tarifaire qui a permis de contenir à 4 % la hausse des prix de l'électricité.

Mis en place en 2022 et prolongé jusqu'en 2023, le guichet d'aide au paiement des factures de gaz et d'électricité, dont le but est entre autres d'éviter l'arrêt des productions essentielles, accompagne les TPE PME pour le paiement de leurs factures jusqu'à 4 millions d'euros.

Les dispositifs complémentaires pour les factures d'énergie 2023

Depuis le 6 janvier 2023, les TPE ne paieront pas plus de 280 €/MWh en moyenne d'électricité. Elles ont donc la possibilité de renégocier leur contrat avec leurs fournisseurs d'énergie.

Le bouclier tarifaire reste en vigueur, mais contient à présent la hausse des prix de l'électricité à 15 % au lieu de 4 %, et ce, depuis le 1er février et jusqu'au 31 décembre 2023. Pour bénéficier de cette mesure, l'entreprise ne doit pas avoir plus de 10 salariés, avoir un chiffre d'affaires inférieur à deux millions d'euros et un compteur électrique d'une puissance maximum de 36 kVA.

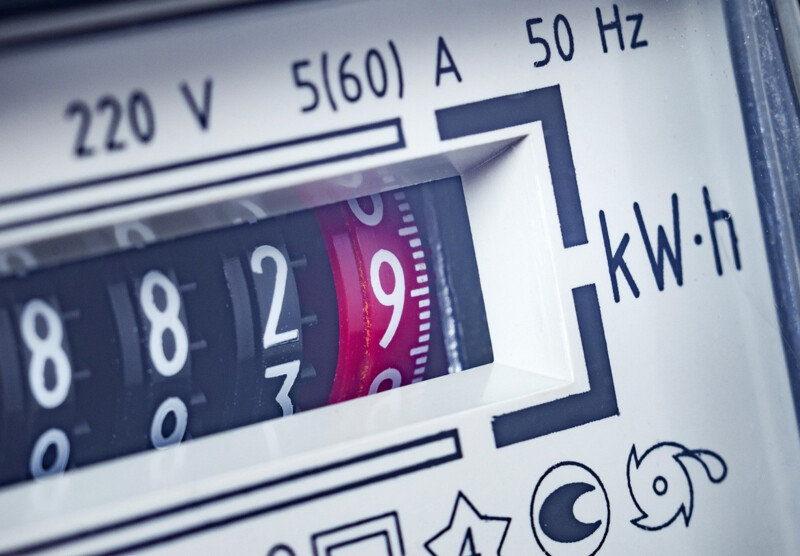

En janvier 2023, l'amortisseur électricité a été mis en place pour protéger les entreprises énergivores ayant signé des contrats d'énergie plus élevés. Concrètement, l'État prend en charge une partie de la facture (environ 20 %) dès que le montant du kilowattheure dépasse 0,35 €. Les entreprises éligibles sont celles qui ont moins de 250 salariés, qui ne bénéficient pas du bouclier tarifaire et dont le compteur a une puissance supérieure à 36 kVA.

Une demande d'aide au paiement des factures de gaz et d'électricité est toujours possible après prise en compte du bénéfice de l'amortisseur électricité. Pour savoir si l'entreprise peut obtenir cette aide, un simulateur est accessible sur le site impots.gouv.fr.

Des facilités de paiement sont accordées aux TPE PME qui en font la demande auprès de leurs fournisseurs d'énergie jusqu'à cet été. Si elles rencontrent des difficultés passagères de trésorerie, elles peuvent obtenir un étalement de leurs factures sur plusieurs mois.

Concernant les impôts et les cotisations sociales, l'État et l'Urssaf proposent aux TPE PME un report de paiement de leurs charges. Les reports ne s'appliquent pas à la TVA ni aux taxes annexes ou encore au reversement de prélèvement à la source.

Depuis le 1er mars 2023, un fonds de garantie est mis en place pour les entreprises grandes consommatrices de gaz ou d'électricité. Le fonds de garantie publique « énergie » leur permet, quels que soient leur taille et leur chiffre d'affaires, de demander aux banques, aux assurances ou aux sociétés de financement de profiter de cautionnements garantis par l'État pour les contrats de fourniture d'énergie.

Les recours en cas de litige

Les TPE peuvent saisir gratuitement le médiateur national de l'énergie pour résoudre les litiges avec leurs fournisseurs. Les PME, quant à elles, saisiront le médiateur des entreprises.

L'ensemble des entreprises rencontrant des difficultés ont la possibilité de se faire accompagner par un conseiller du conseil départemental. Celui-ci a pour rôle de chercher avec les dirigeants des solutions adaptées à chaque situation.